321

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

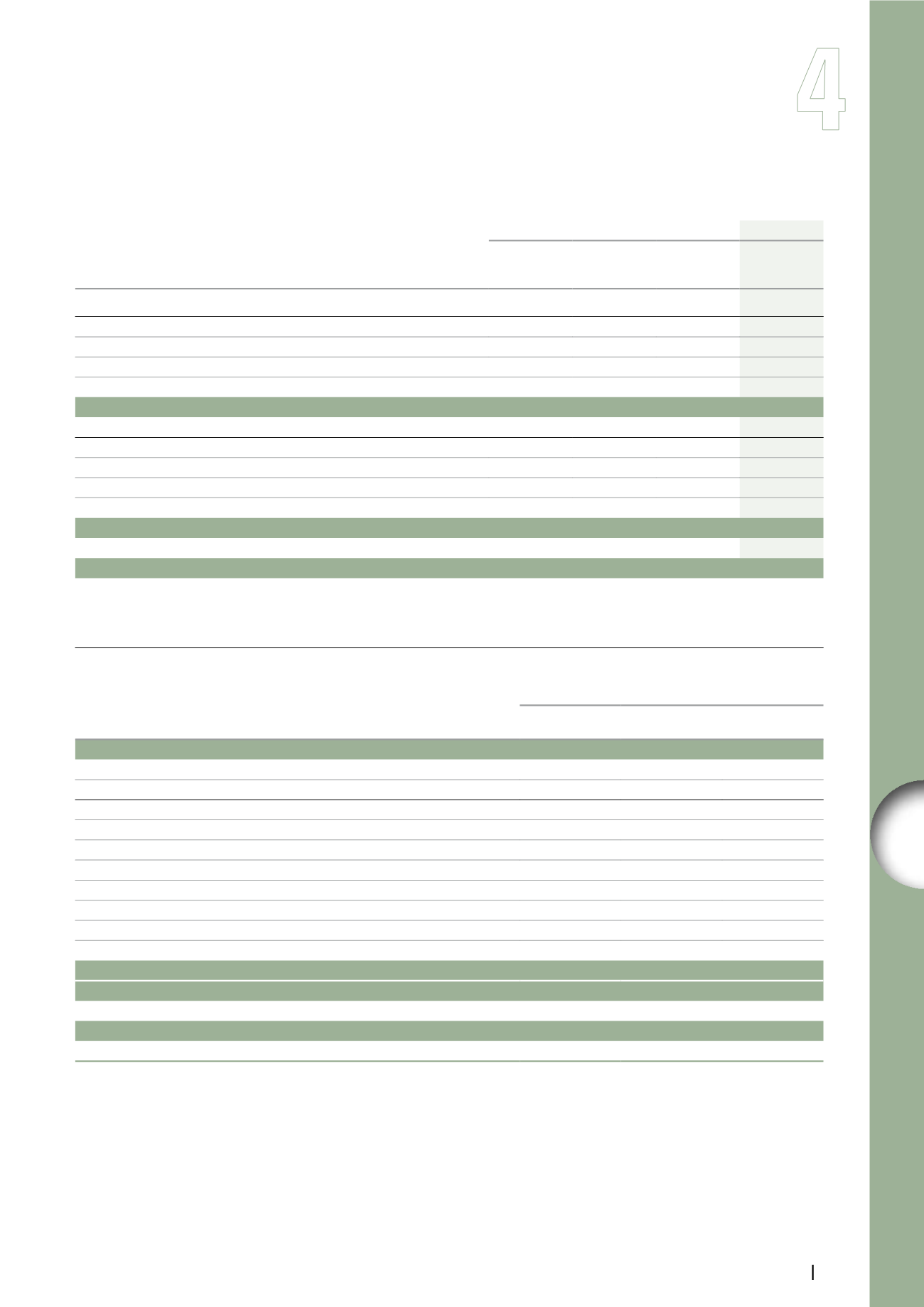

Note 33. Adjustment of comparative information

(in millions of euros, except per share amounts)

2012

2013

Nine months

ended

September 30,

Three months

ended

December 31,

Year

ended

December 31,

Three months

ended

March 31,

Earnings before interest and income taxes (EBIT) (as previously published)

3,834

(956)

2,878

1,178

Reclassifications related to the application of IFRS 5 for Activision Blizzard

-750

-378

-1,128

-440

Reclassifications related to the application of IFRS 5 for Maroc Telecom Group

-710

-252

-962

-266

Adjustments related to the application of amended IAS 19

Selling, general and administrative expenses

+6

+11

+17

na

Earnings before interest and income taxes (EBIT) (restated)

2,380

(1,575)

805

472

Earnings attributable to Vivendi SA shareowners (as previously published)

1,651

(1,487)

164

534

Adjustments related to the application of amended IAS 19

Selling, general and administrative expenses

+6

+11

+17

na

Other financial charges

+1

-

+1

na

Provision for income taxes

-

-3

-3

na

Earnings attributable to Vivendi SA shareowners (restated)

1,658

(1,479)

179

534

Earnings attributable to Vivendi SA shareowners per share (as previously published)

1.28

(1.12)

0.13

0.40

Earnings attributable to Vivendi SA shareowners per share (restated)

1.28

(1.12)

0.14

0.40

na: not applicable.

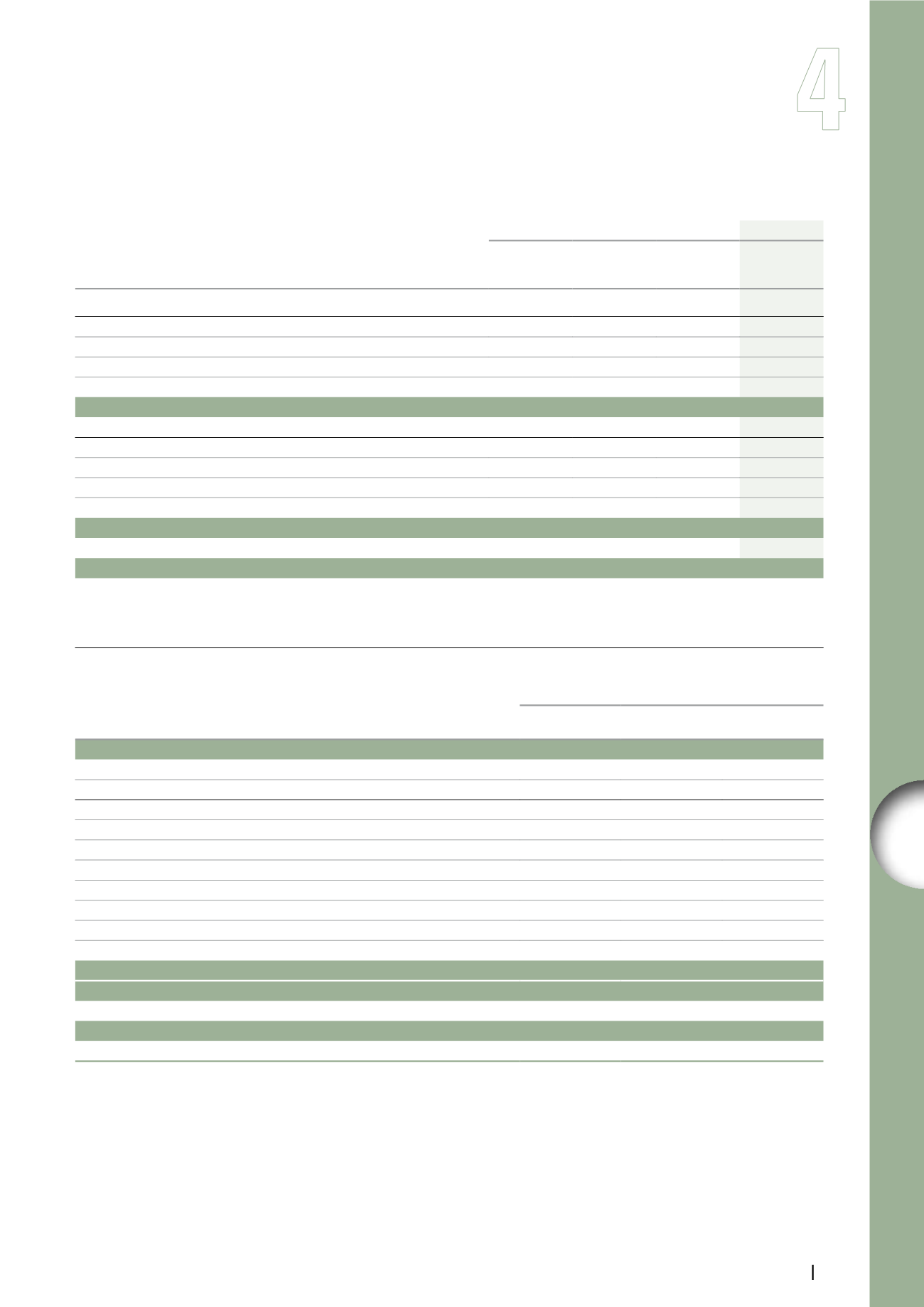

33.2.

Adjustments related to charges and income directly recognized in equity

(in millions of euros)

Year ended December 31, 2012

Published

Application of

amended IAS 19

Restated

Earnings

949

+15

964

Actuarial gains/(losses) related to employee defined benefit plans, net

-

-61

(61)

Items not reclassified to profit or loss

-

-61

(61)

Foreign currency translation adjustments

(605)

-

(605)

Unrealized gains/(losses), net

103

-

103

Cash flow hedge instruments

22

-

22

Net investment hedge instruments

17

-

17

Tax

1

-

1

Hedging instruments, net

40

-

40

Assets available for sale, net

63

-

63

Items to be subsequently reclassified to profit or loss

(502)

-

(502)

Charges and income directly recognized in equity

(502)

-61

(563)

Total comprehensive income

447

-46

401

of which

Total comprehensive income attributable to Vivendi SA shareowners

(317)

-45

(362)

Total comprehensive income attributable to non-controlling interests

764

-1

763