06

Non-Financial Indicators Handbook -

2013

-

VIVENDI

2

Integrated Reporting

Pilot Project

Intangible cultural capital: the impact of the Group's investment in diversity

of content on value creation

As Vivendi plans to focus on its media and content activities, and considering the growing demand from the

Group’s different stakeholders to better understand its overall performance, the General Management has launched

an integrated reporting pilot project to illustrate how promoting cultural diversity, one of the strategic issues of

Vivendi’s CSR policy, creates societal and financial value while preventing risks and opening up opportunities to

win markets.

■

The Challenge

Vivendi exerts a human, cultural and intellectual influence on the lives of millions

of customers and citizens worldwide due to the activities of the Universal

Music Group, the world leader in music; the Canal+ Group, the leading French

media company also active in French-speaking Africa as well as Poland and

Vietnam, and its subsidiary Studiocanal, which is aleading European player in

the production, acquisition, and international distribution and sales of films and

TV series. Vivendi has a societal responsibility to satisfy the curiosity and varied

tastes of its audiences on all continents, to help these audiences achieve their

full potential, and to provide the necessary conditions for them to become open

to the world andexercise their critical judgment.

In addition, cultural diversity is at the heart of Vivendi’s businesses: music,

television and film. Providing rich, original content; signing new artists in all

categories; avoiding creative talent drain; meeting the expectations of our

subscribers; making our platform attractive in a digital environment that disrupts

the well-established practices – these are the goals being pursued by our

businesses as they strive to preserve their leading position in their respective

markets (please refer to diagram below).

■

The Approach

Vivendi decided to take a pragmatic approach to this pilot project and to

implement it initially on a limited basis at Universal Music France, Canal+ in

France, and Studiocanal. Led by Vivendi’s Corporate Social Responsibility (CSR)

Department, this initiative brought together the managers in charge of Finance

and Strategy of these three entities of the Group and analysts representing

investors (Amundi, Groupama AM, and Oddo Securities). Indicators establishing

the link between investments in diversity of content and returns were chosen

(please refer below). The materiality of these indicators was then submitted to

analysts for review.

The chief financial officers of Vivendi’s businesses have welcomed and given

their full support to this approach and the analysts whose views were sought

believe it to be innovative, scalable and fully integrated into the strategy of a key

player in the media sector.

The aim is to enhance the value of the pilot project by 2015 through monitoring

indicators and widening the scope of the project to include other CSR issues,

after consultation with the Group’s main stakeholders.

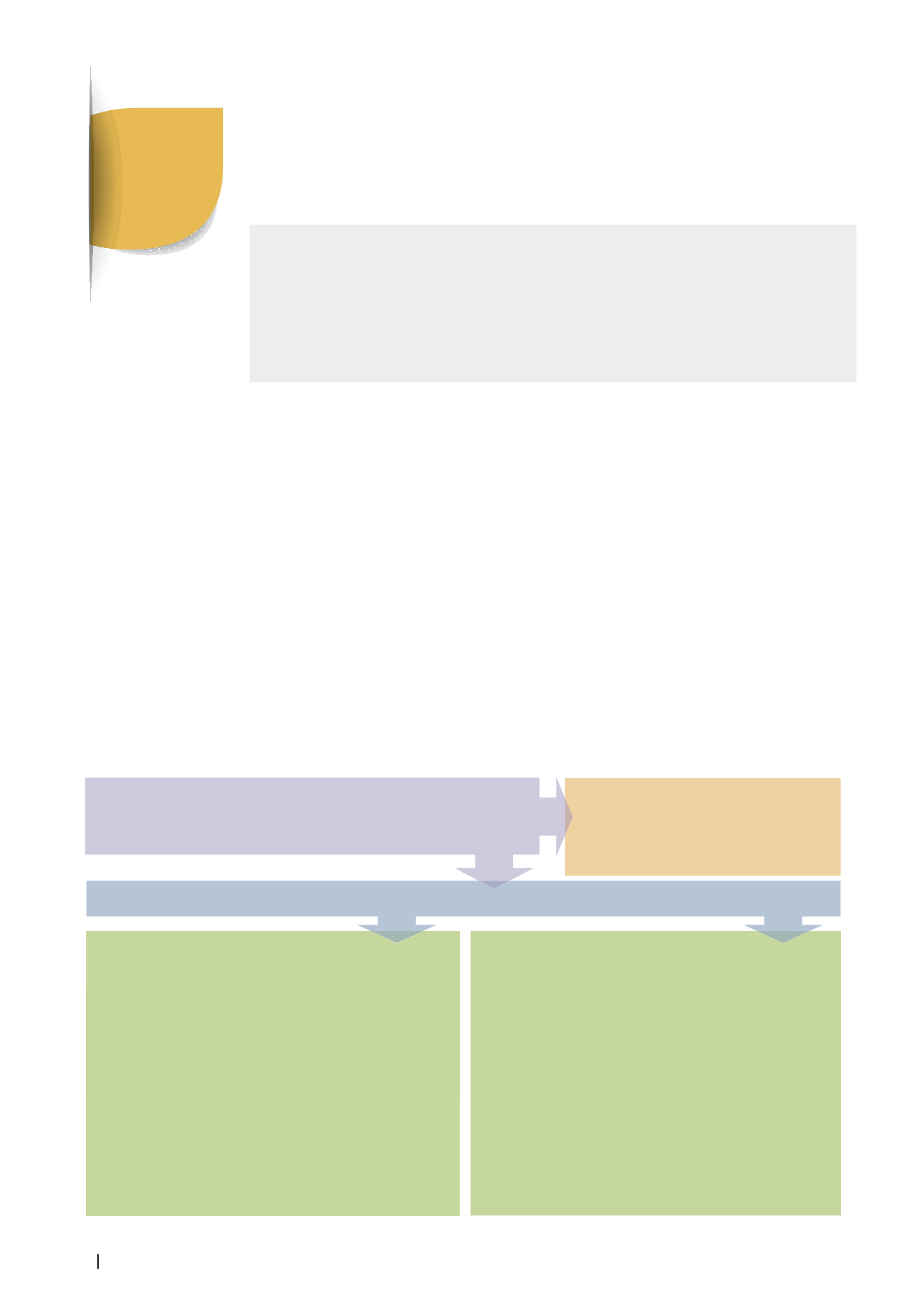

Contribution to value creation of investment in diversity of content

(2013 figures)

CSR ISSUE

FINANCIAL VALUE

UNIVERSAL MUSIC FRANCE

(excluding Publishing)

CANAL + GROUP

CANAL+ AND CANALSAT

Survey results of Canal+ subscribers:

–

"Canal+ is a truly original network, different from the others": 77% agree

–

"Canal+ is a network that discovers and showcases new talent": 70% agree

–

"The films aired by the network are of varied genres": 90% agree

Survey results of Canalsat subscribers:

–

"Canalsat opens me up to the world and benefits me": 74% agree

STUDIOCANAL

Investment in European cinematographic works as an absolute value

and as a percentage: €129 million out of €181 million, or 71%.

SOCIETAL VALUE

To promote cultural diversity in the content offering

To invest in new talent and sign new artists

To promote cultural heritage by exploiting an exceptional catalog of content

To promote our audience’s participation in cultural

life, a source of personal fulfillment

To enable increased access to knowledge

and entertainment

To enhance mutual understanding and social ties

Growth in revenues

Improved profitability

Greater exposure of the brands

Value creation

Investment devoted to marketing new talent as a percentage

of total investment: 21%

Percentage of revenue earned by new talent: 10%

Percentage of digital revenue and physical revenue earned by the catalog

(works marketed for more than two years)

–

Weight of physical catalog: 20.3%

–

Weight of digital catalog: 44.7%

Number of new artists signed: 49

Portion of revenue earned by each musical genre (local, international, classical

and jazz, and compilations)

–

Local revenue: 53%

–

International revenue: 26%

–

Classical and jazz revenue: 8%

–

Compilation revenue: 13%

For Universal Music France, investing in diverse musical genres increases the market shares of its

different labels; promoting the catalog stimulates digital and physical sales; and attracting new

signatures of confirmed artists or of new talent provides a rich pool of artistic talent able to contribute

to the Company’s sustainable performance.

The figures for Canal+ and Canalsat show the direct link between a diversified original program offering

and subscriber satisfaction. The investments by Studiocanal in European cinematographic works make

it possible to develop an offering able to complement the offerings of the US major film studios on the

international market and to achieve an above-average return compared to its competitors.

Source: Studiocanal

Source: UMF

Source: Canal+ and Canalsat subscriber poll, 2013