302

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 27. Contractual obligations and other commitments

Note 27.

Contractual obligations and other commitments

Vivendi’s material contractual obligations and contingent assets and

liabilities include:

contracts entered into, which relate to the group’s business

operations, such as content commitments (please refer to

Note 11.2), contractual obligations and commercial commitments

recorded in the Statement of Financial Position, including finance

leases (please refer to Note 13), off-balance sheet operating leases

and subleases and off-balance sheet commercial commitments,

such as long-term service contracts and purchase or investment

commitments;

commitments related to the group’s scope contracted through

acquisitions or divestitures such as share purchase or sale

commitments, contingent assets and liabilities subsequent to given

or received commitments related to the divestiture or acquisition of

shares, commitments resulting from shareholders’ agreements and

collateral and pledges granted to third parties over Vivendi’s assets;

commitments related to the group’s financing: borrowings issued

and undrawn confirmed bank credit facilities as well as the

management of interest rate, foreign currency and liquidity risks

(please refer to Notes 23 and 24); and

contingent assets and liabilities related to litigation in which Vivendi

and/or its subsidiaries are either plaintiff or defendant (please refer

to Note 28).

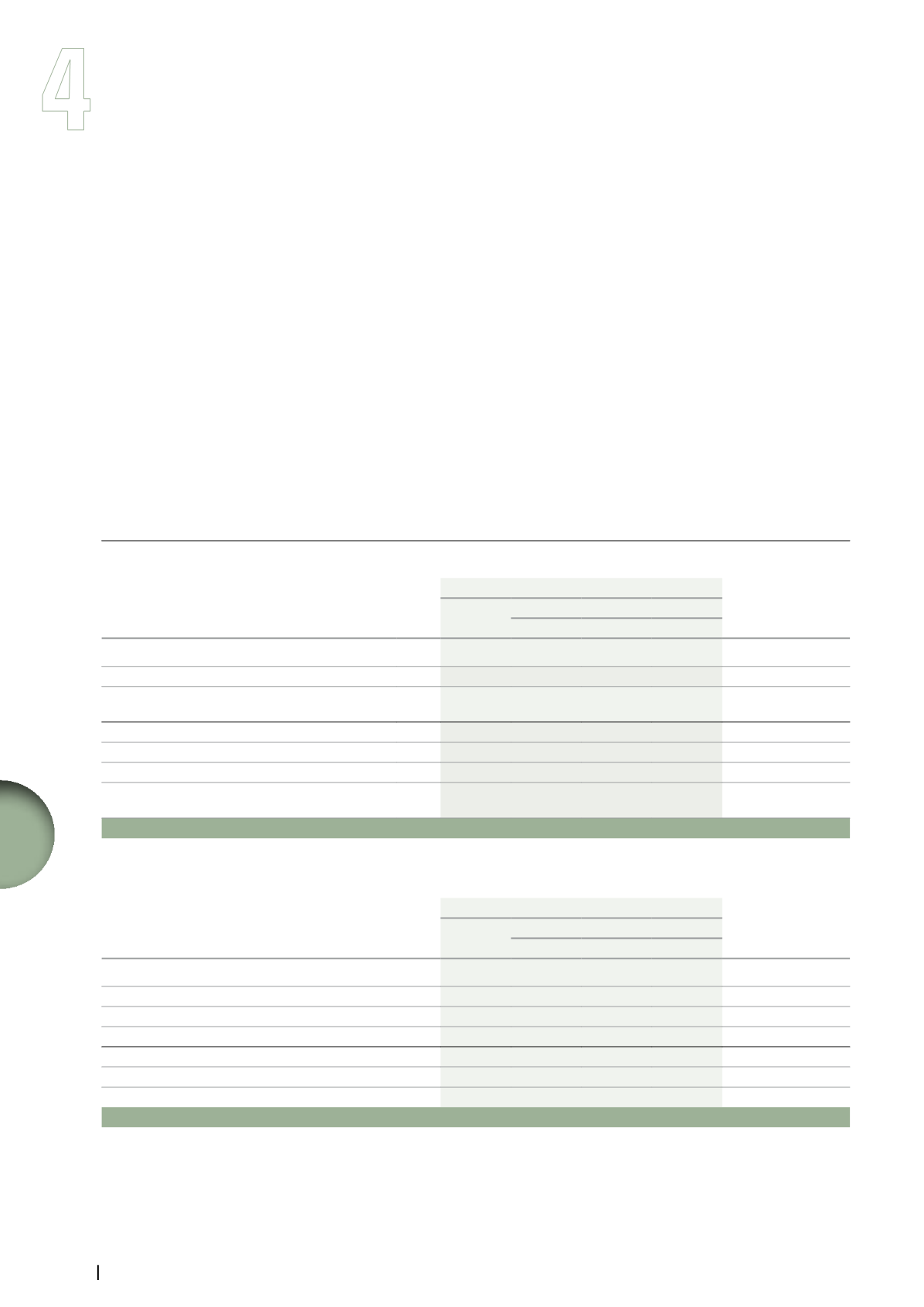

27.1.

Contractual obligations and commercial commitments

(in millions of euros)

Note

As of December 31, 2013

Total as of

December 31, 2012

Total

Due in

2014 2015-2018 After 2018

Borrowings and other financial liabilities

24.2.3

13,967

3,925

6,275

3,767

20,338

Content liabilities

11.2

2,335

2,245

88

2

2,283

Future minimum payments related to the consolidated

statement of financial position items

16,302

6,170

6,363

3,769

22,621

Contractual content commitments

11.2

4,298

2,118

2,124

56

4,939

Commercial commitments

27.1.1

2,209

1,057

806

346

2,697

Operating leases and subleases

27.1.2

2,700

454

1,284

962

2,735

Items not recorded in the consolidated statement

of financial position

9,207

3,629

4,214

1,364

10,371

Contractual obligations and commercial commitments

25,509

9,799

10,577

5,133

32,992

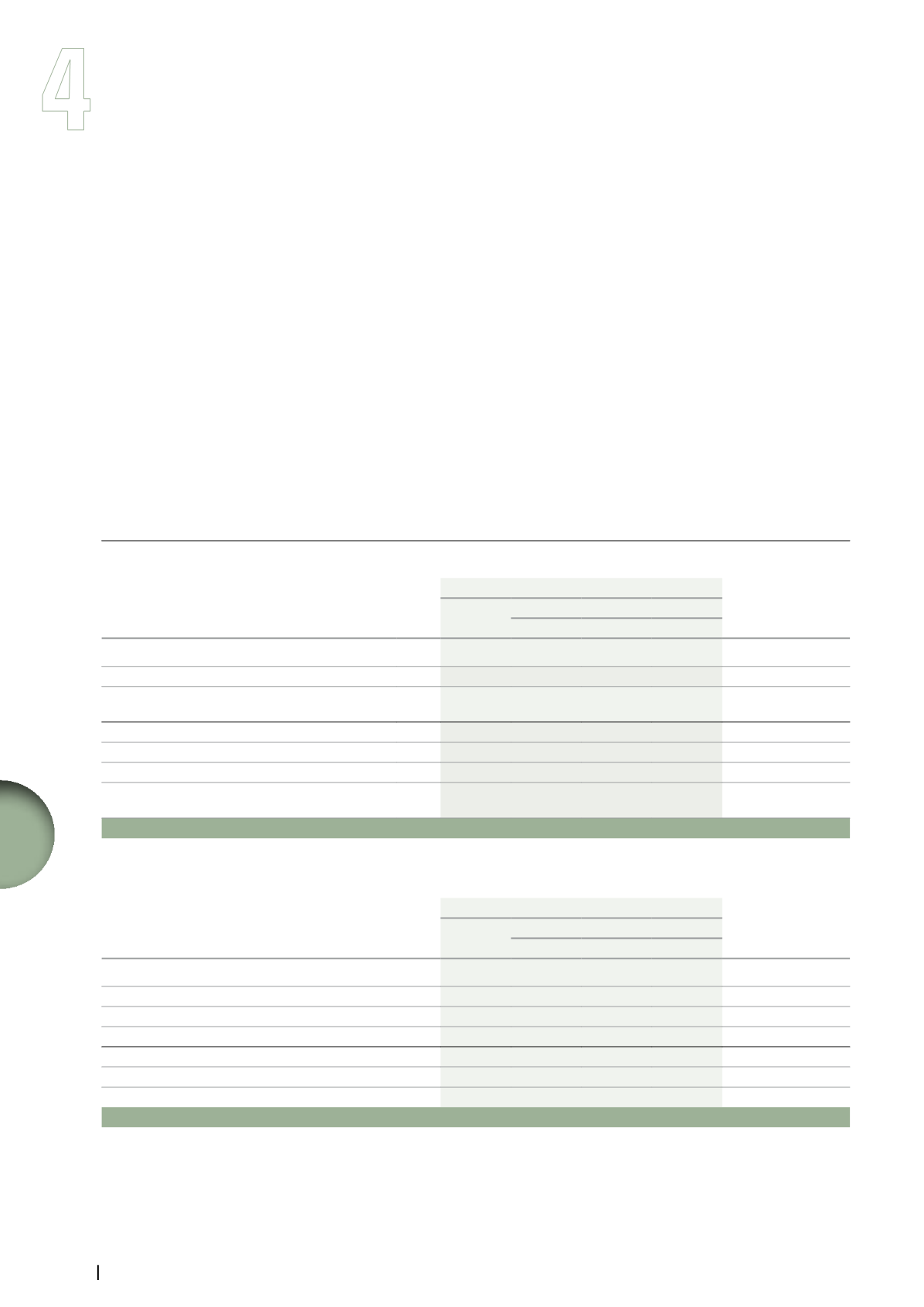

27.1.1.

Off-balance sheet commercial commitments

(in millions of euros)

Minimum future payments as of December 31, 2013

Total minimum future

payments as of

December 31, 2012

Total

Due in

2014 2015-2018 After 2018

Satellite transponders

686

102

345

239

846

Investment commitments

1,078

802

154

122

1,273

Other

732

265

419

48

786

Given commitments

2,496

1,169

918

409

2,905

Satellite transponders

(159)

(97)

(62)

-

(201)

Other

(128)

(15)

(50)

(63)

(7)

Received commitments

(287)

(112)

(112)

(63)

(208)

Net total (a)

2,209

1,057

806

346

2,697

(a)

The decrease in off-balance sheet commercial commitments was mainly related to Maroc Telecom Group, whose sale by Vivendi is underway

(€316 million as of December 31, 2012): please refer to Note 7.2.