303

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

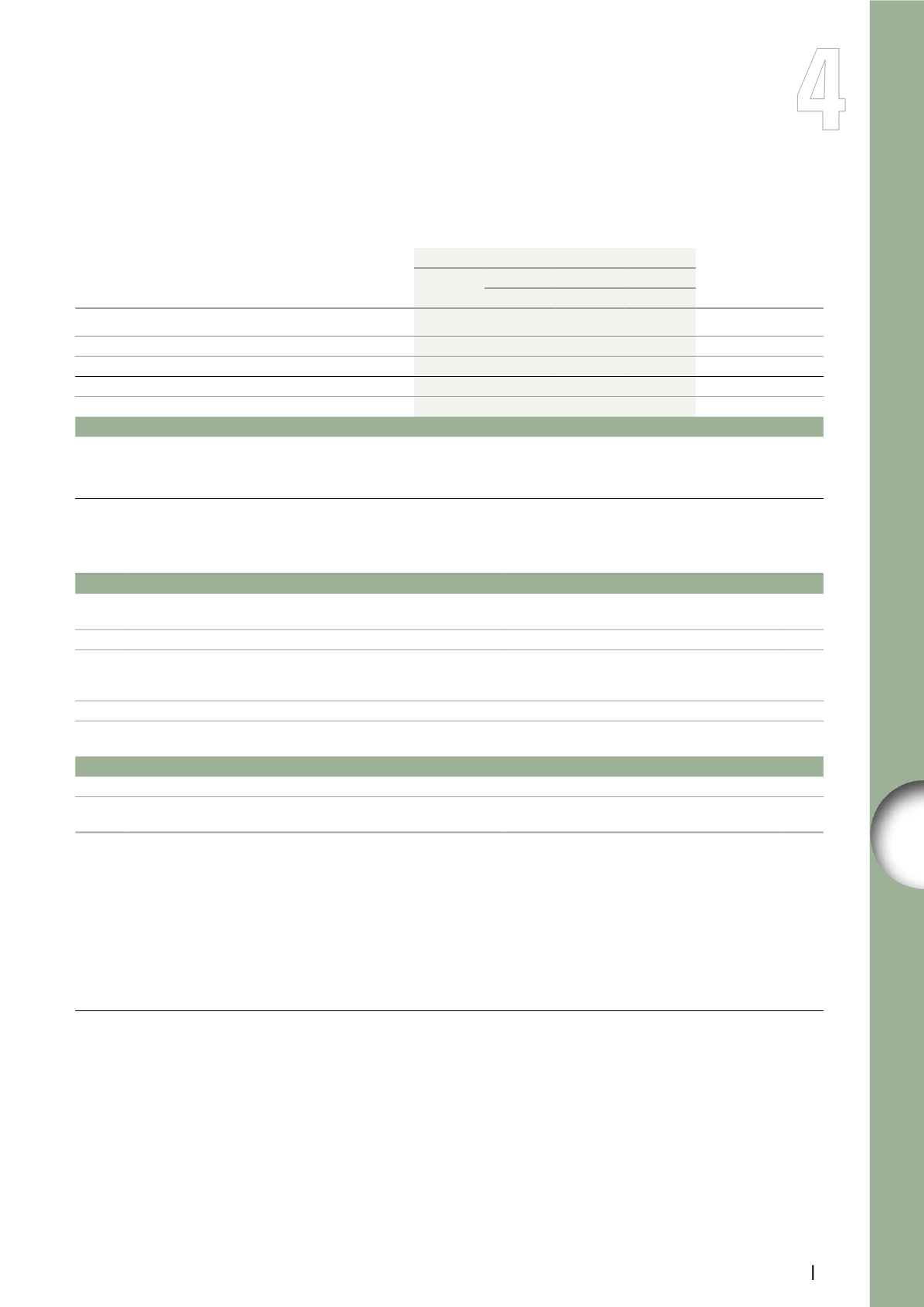

Note 27. Contractual obligations and other commitments

27.1.2.

Off-balance sheet operating leases and subleases

(in millions of euros)

Minimum future leases as of December 31, 2013

Total minimum

future leases as of

December 31, 2012

Total

Due in

2014 2015-2018 After 2018

Buildings

(a)

2,695

427

1,282

986

2,633

Other

221

67

103

51

212

Leases

2,916

494

1,385

1,037

2,845

Buildings

(a)

(216)

(40)

(101)

(75)

(110)

Subleases

(216)

(40)

(101)

(75)

(110)

Net total

2,700

454

1,284

962

2,735

(a)

Mainly relates to offices and technical premises.

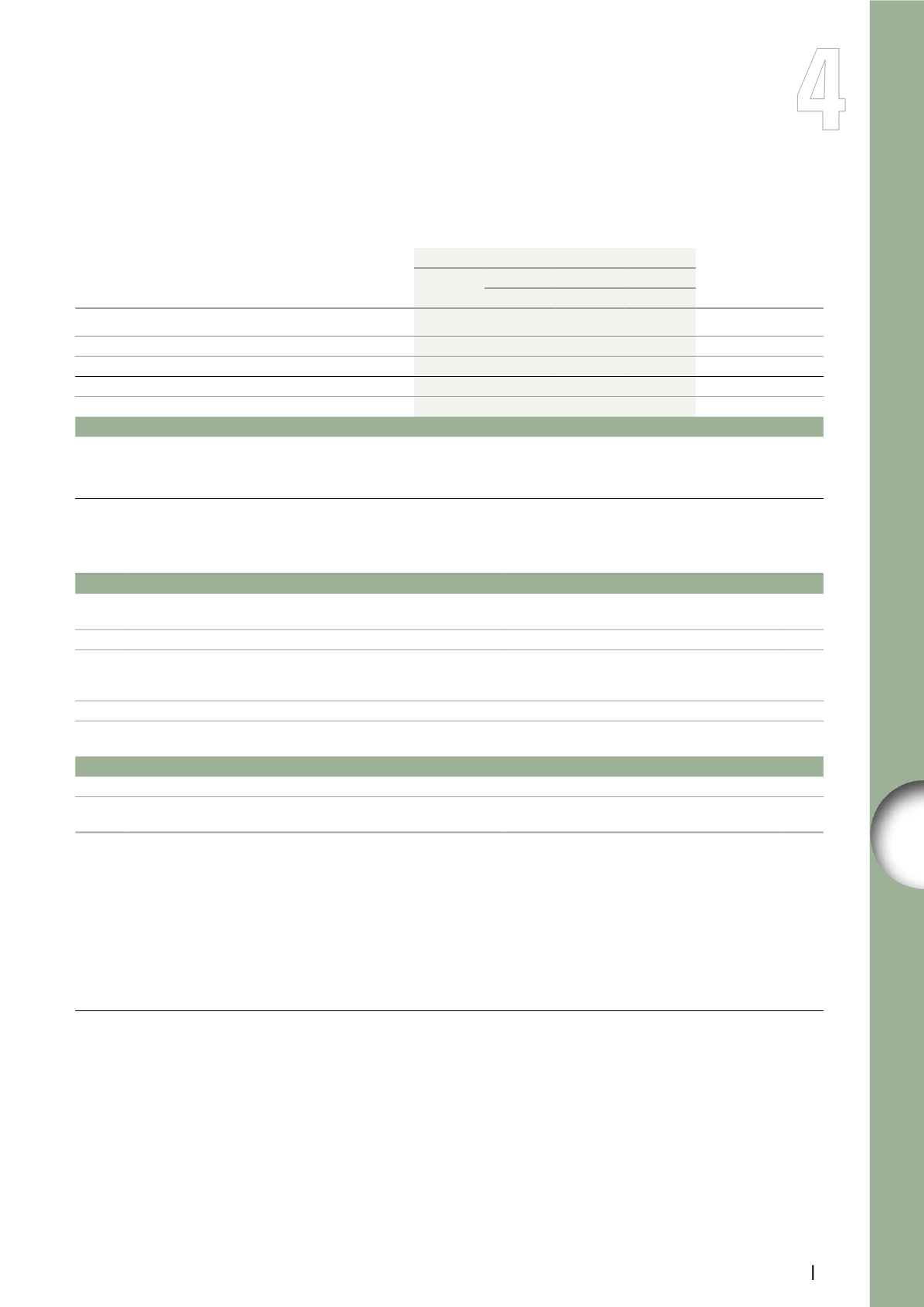

27.2.

Other commitments given or received relating to operations

Ref.

Context

Characteristics (nature and amount)

Expiry

Given commitments

Individual rights to training for French employees

Approximately 1.6 million hours (unchanged

compared to December 31, 2012).

-

SFR’s network coverage commitments related to telecom licenses

Please refer to Note 14.

-

(a)

GSM-R commitments

Bank guarantee, joint and several guarantees

with Synérail for a total amount of €105 million

(compared to €92 million as of December 31, 2012).

-

Obligations in connection with pension plans and post-retirement benefits

Please refer to Note 21.

-

(b)

Other guarantees given

Cumulated amount of €156 million (compared

to €190 million as of December 31, 2012).

-

Received commitments

(c)

Agreements on the digital distribution of music rights

Minimum guarantees.

-

(d)

Other guarantees received

Cumulated amount of €1 million (compared

to €191 million as of December 31, 2012).

-

(a)

On February 18, 2010, a group comprised of SFR, Vinci and AXA (30% each) and TDF (10%) entered into a contract with Réseau Ferré de France

regarding the public-private partnership GSM-R. This 15-year contract, valued at approximately €1 billion, covers the financing, building, operation

and maintenance of the digital telecommunications network that enables conference mode communications (voice and data) between train drivers

and teams on the ground. It will be rolled out gradually until 2015 over 14,000 km of conventional and high-speed railway lines in France.

(b)

Vivendi grants guarantees in various forms to financial institutions on behalf of its subsidiaries in the course of their operations.

(c)

Mainly relates to commitments received by UMG from third parties in connection with agreements subject to minimum guarantees on the digital

distribution of music rights.

(d)

The decrease in other guarantees received was notably related to the plan to sell Maroc Telecom Group (please refer to Note 7.2).

27.3.

Share purchase and sale commitments

In connection with the purchase or sale of operations and financial

assets, Vivendi has granted or received commitments to purchase or

sell securities.

On November 4, 2013, Vivendi notably committed to sell its interest in

Maroc Telecom Group (please refer to Note 7.2).

In connection with the sale of a majority of Vivendi’s interest in

Activision Blizzard, completed on October 11, 2013, Vivendi’s remaining

interest in Activision Blizzard (83 million shares) is subject to lock-up

provisions (please refer to Note 7.1).

The liquidity rights regarding the strategic partnership among Canal+

Group, ITI, and TVN are detailed in Note 27.5 below.

Furthermore, Vivendi and its subsidiaries have granted or received

purchase or sale options related to shares in equity affiliates and

unconsolidated investments.