1

Group Profile

| Businesses | Litigation | Risk Factors

Key Figures

France

5,409

33,558

2,725

South and

Central America

18,346

Europe (excluding France)

4,753

Africa

937

Asia-Pacific

1,388

North America

GVT

(a)

17,987

33,558

15,571

(except GVT)

Canal+ Group

7,033

Corporate

198

Vivendi Village

748

Universal Music Group

7,592

2014

2013

Earnings attributable to Vivendi SA shareowners

Adjusted Net Income

4,744

626

1,967

454

2014

0.46

2013

0.34

0

2014

2013

999

955

2014

2013

(4,637)

22,988

11,097

19,030

(Net Cash Position)/Financial

Net Debt

(a)

Equity

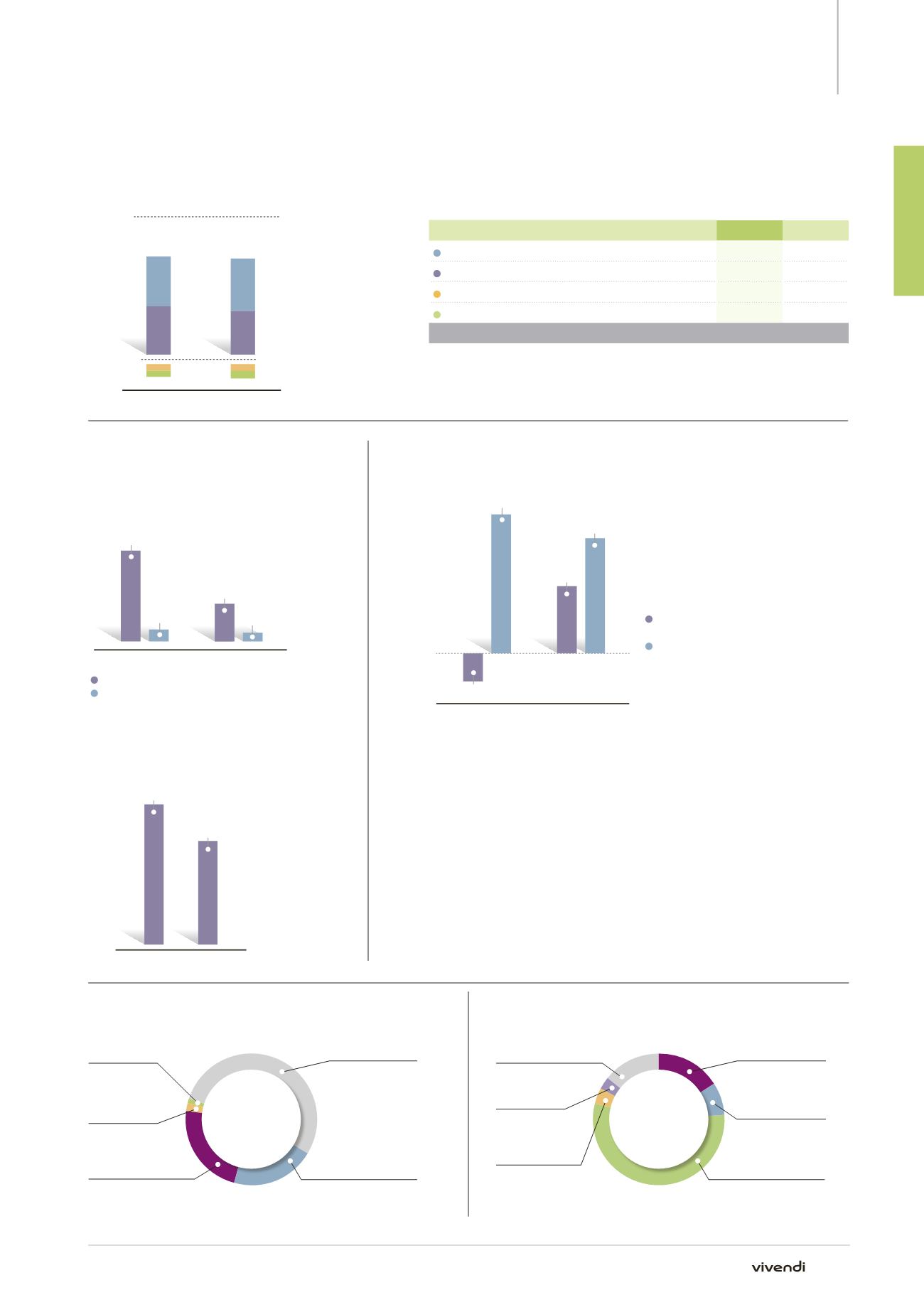

EBITA by business segment

December 31 – in millions of euros

2014

2013

Canal+ Group

583

611

Universal Music Group

565

511

Vivendi Village

(79)

(80)

Corporate

(70)

(87)

Total

999

955

Earnings attributable to Vivendi SA

shareowners and Adjusted Net

Income

December 31 – in millions of euros

Adjusted Net Income per share

December 31 – in euros

(Net Cash Position)/Financial Net Debt and equity

December 31 – in millions of euros

(a)

Vivendi considers Net Cash Position and Financial Net Debt non-GAAP measures to be relevant indicators in measuring

Vivendi’s treasury and capital resources position:

–– Net Cash Position is calculated as the sum of cash and cash equivalents as reported on the Consolidated Statement

of Financial Position, derivative financial instruments in assets, and cash deposits backing borrowings (included in

the Consolidated Statement of Financial Position under “financial assets”) less long-term and short-term borrowings

and other financial liabilities.

–– Financial Net Debt is calculated as the sum of long-term and short-term borrowings and other financial liabilities

as reported on the Consolidated Statement of Financial Position, less cash and cash equivalents as reported on the

Consolidated Statement of Financial Position as well as derivative financial instruments in assets and cash deposits

backing borrowings (included in the Consolidated Statement of Financial Position under “financial assets”).

Net Cash Position and Financial Net Debt should be considered in addition to, and not as substitutes

for, other GAAP measures as presented in the Consolidated Statement of Financial Position, as well as

other measures of indebtedness reported in accordance with GAAP, and Vivendi considers that they are

relevant indicators of the treasury and capital resources position of the group. Vivendi Management

uses these indicators for reporting, management, and planning purposes, as well as to comply with

certain of Vivendi's debt covenants.

Headcount by business segment

December 31, 2014

(a)

Discontinued operation.

Headcount by geographic region

December 31, 2014

11

Annual Report 2014