4

Non-GAAP measures in Statement of Earnings

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

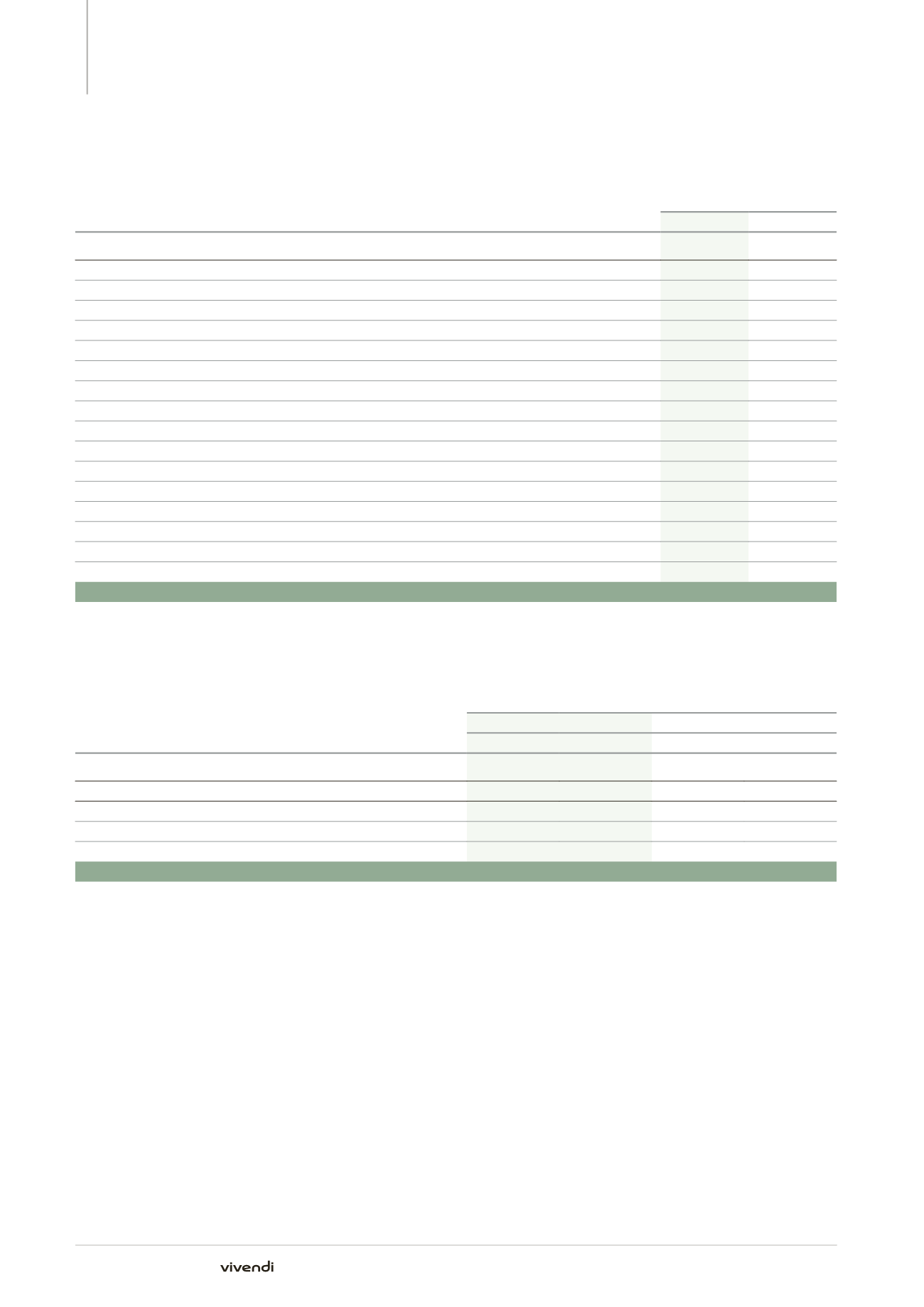

Reconciliation of earnings attributable to Vivendi SA shareowners to adjusted net income

(in millions of euros)

Year ended December 31,

2014

2013

Earnings attributable to Vivendi SA shareowners

(a)

4,744

1,967

Adjustments

Amortization of intangible assets acquired through business combinations

344

350

Impairment losses on intangible assets acquired through business combinations

(a)

92

6

Other income

(a)

(203)

(88)

Other charges

(a)

30

50

Other financial income

(a)

(19)

(13)

Other financial charges

(a)

751

300

Earnings from discontinued operations

(a)

(5,262)

(2,633)

of which capital gain on the divestiture of SFR

(2,378)

-

impairment of SFR’s goodwill

-

2,431

capital gain on the divestiture of Maroc Telecom group

(786)

-

capital gain on Activision Blizzard shares

(84)

(2,915)

Change in deferred tax asset related to Vivendi SA’s French Tax Group and to the Consolidated Global Profit Tax Systems

37

(109)

Non-recurring items related to provision for income taxes

5

28

Provision for income taxes on adjustments

(112)

(106)

Non-controlling interests on adjustments

219

702

Adjusted net income

626

454

(a)

As reported in the Consolidated Statement of Earnings.

Adjusted net income per share

Year ended December 31,

2014

2013

Basic

Diluted

Basic

Diluted

Adjusted net income

(in millions of euros)

626

626

454

454

Number of shares

(in millions)

Weighted average number of shares outstanding

(a)

1,345.8

1,345.8

1,330.6

1,330.6

Potential dilutive effects related to share-based compensation

-

5.5

-

4.7

Adjusted weighted average number of shares

1,345.8

1,351.3

1,330.6

1,335.3

Adjusted net income per share

(in euros)

0.46

0.46

0.34

0.34

(a)

Net of treasury shares (50,033 shares as of December 31, 2014).

192

Annual Report 2014