4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

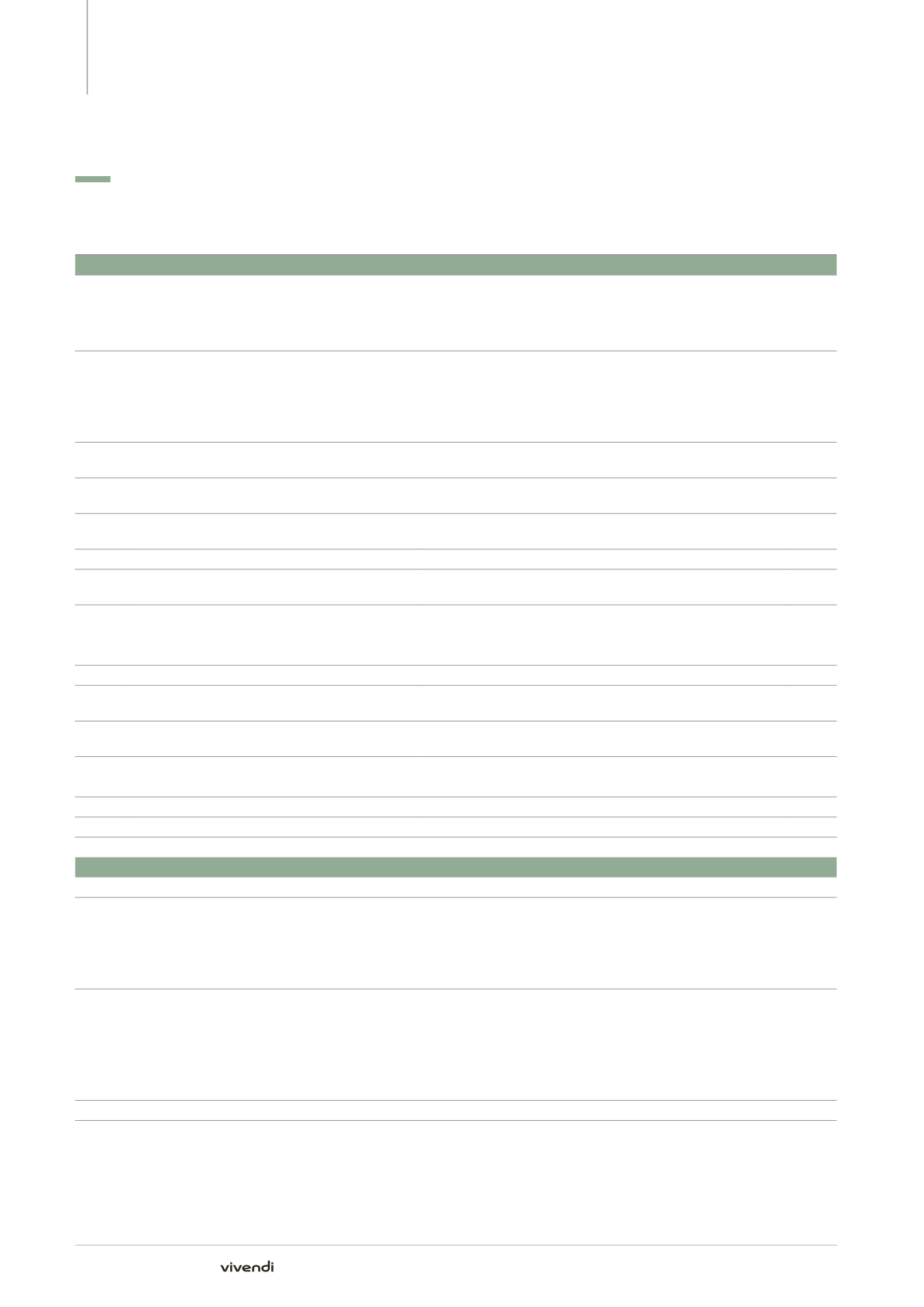

Note 25. Contractual obligations and other commitments

25.4.

Contingent assets and liabilities subsequent to given or received commitments related

to the divestiture or acquisition of shares

Ref.

Context

Characteristics (nature and amount)

Expiry

Contingent liabilities

(a)

Acquisition of Bolloré Group’s channels (September 2012)

Commitments undertaken, in connection with the authorization

of the acquisition, with:

p

p

the French Competition Authority; and

2017

p

p

the French Broadcasting Authority.

2015

Merger of Cyfra+ and “n” platforms (November 2012)

Reciprocal guarantees in favor of TVN:

p

p

PLN 1 billion in the event of a breach of any representation or warranty or

covenants; and

2015

p

p

PLN 300 million in the event of a breach of specific representation

or warranty.

-

(b)

Canal+ Group’s pay-TV activities in France

(January 2007-July 2017)

New approval of the acquisition of TPS and Canalsatellite subject to compliance

with injunctions ordered by the French Competition Authority.

2017

(c)

Divestiture of Canal+ Nordic (October 2003)

Distribution guarantees expired as of December 31, 2014 given in favor of Canal

Digital and Telenor Broadcast Holding by a former subsidiary.

2014

(d)

Divestiture of NC Numericable (March 2005)

Specific guarantees capped at €241 million (including tax and social risks),

expired as of December 31, 2014.

2014

Divestiture of PSG (June 2006)

Unlimited specific guarantees.

2018

Divestiture of UMG manufacturing and distribution operations

(May 2005)

Various commitments for manufacturing and distribution services.

2018

(e)

NBC Universal transaction (May 2004) and subsequent

amendments (2005-2010)

p

p

Breaches of tax representations;

-

p

p

Obligation to cover the Most Favored Nation provisions; and

p

p

Claims related to remedial actions: on May 11, 2014 at the latest.

2014

(f)

Divestiture of Sithe (December 2000)

Specific guarantees capped at $480 million.

-

(g)

Sale of real estate assets (June 2002)

Autonomous first demand guarantees capped at €150 million in total

(tax and decennial guarantees).

2017

(h)

Divestiture of PTC shares (December 2010)

Commitments undertaken in order to end litigation over the share ownership of

PTC in Poland.

-

(i)

Sale of Activision Blizzard (October 2013)

p

p

Unlimited general guarantees; and

-

p

p

Tax guarantees capped at $200 million, under certain circumstances.

-

Sale of Maroc Telecom group (May 2014)

Commitments undertaken in connection with the sale (please refer to Note 3.3).

-

Sale of SFR (November 2014)

Commitments undertaken in connection with the sale (please refer to Note 3.1).

-

Other contingent liabilities

Cumulated amount of €7 million (unchanged compared to December 31, 2013).

-

Contingent assets

(a)

Acquisition of Bolloré Group’s channels (September 2012)

Guarantees capped at €120 million.

2017

Acquisition of 40% of N-Vision (November 2012)

Guarantees made by ITI capped at approximately:

p

p

€28 million for general guarantees, expired on May 30, 2014; and

2014

p

p

€277 million for specific guarantees (including tax matters, free and full

ownership of shares sold, authorizations/approvals for the exercise of the

activity).

-

Merger of Cyfra+ and “n” platform (November 2012)

Reciprocal guarantees in favor of TVN:

p

p

PLN 1 billion in the event of a breach of any representation or warranty or

covenants;

2015

p

p

PLN 300 million in the event of a breach of specific representation

or warranty; and

-

p

p

PLN 145 million related to Neovision’s unutilized tax losses carriedforward.

-

Acquisition of Kinowelt (April 2008)

Specific guarantees, notably on film rights were granted by the sellers.

-

278

Annual Report 2014