3

Information about the Company

| Corporate Governance | Reports

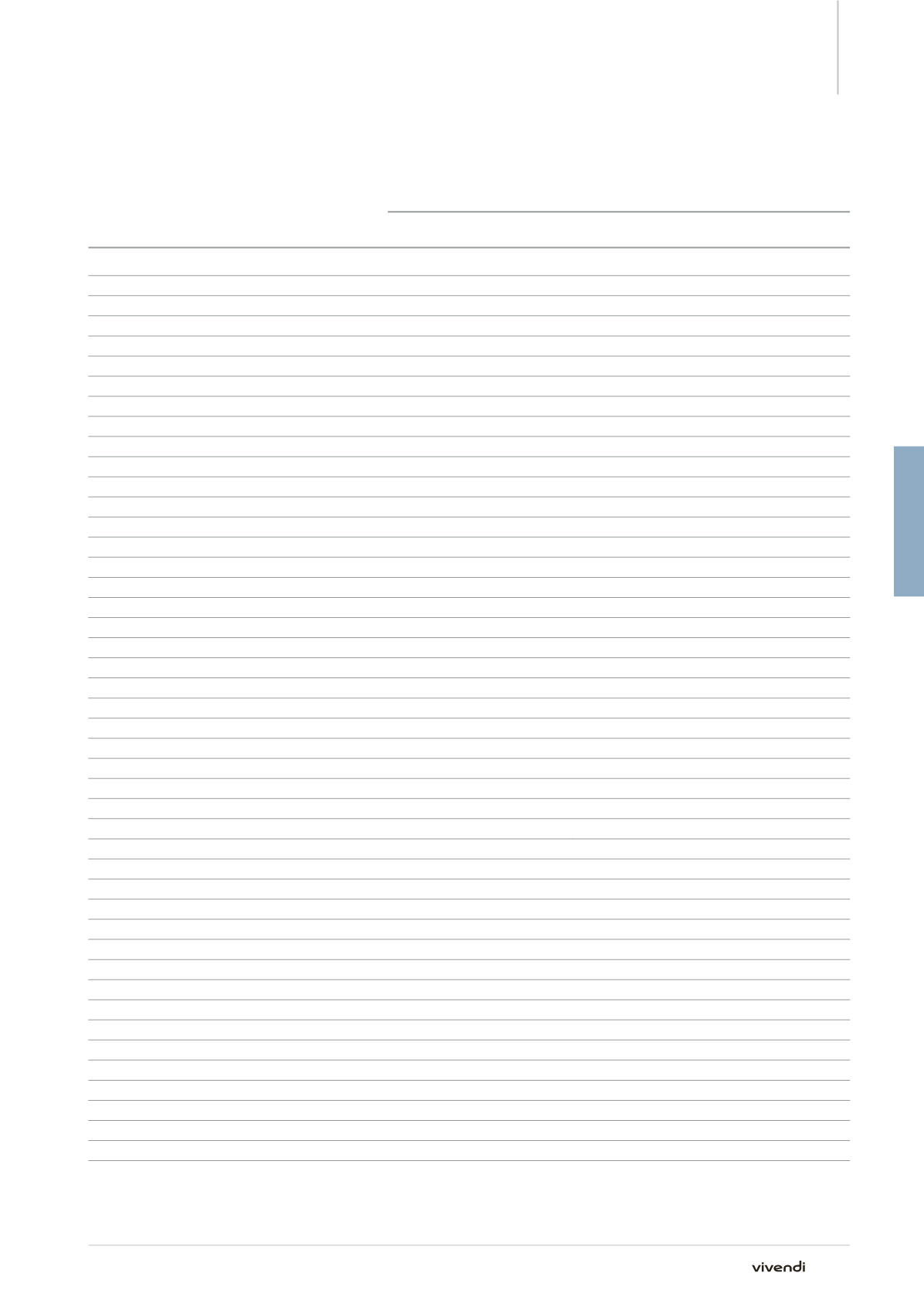

Share Capital

2.2.10.

Changes in Share Capital over the Last Five Years

Transactions

Amount

Share capital amounts

Date

Par value

(in euros)

Premium

(in euros)

Number of

issued shares

In shares

In euros

Share capital as of December 31, 2009

1,228,859,491 6,758,727,200.50

Exercise of stock options

01/31/10

5.50

8.90

2,000 1,228,861,491 6,758,738,200.50

Exercise of stock options

02/28/10

5.50

8.90

200 1,228,861,691 6,758,739,300.50

Exercise of stock options

03/31/10

5.50

8.90

42,000 1,228,903,691 6,758,970,300.50

Grant of performance shares (April 2008)

04/19/10

5.50

na

429,078 1,229,288,569 6,761,087,129.50

Exercise of stock options

04/28/10

5.50

(*)

7.91

14,000 1,229,346,769 6,761,407,229.50

Exercise of stock options

07/31/10

5.50

7.89

8,963 1,229,355,732 6,761,456,526.00

2010 Group Savings Plan

07/29/10

5.50

(*)

8.281

7,141,109 1,236,496,841 6,800,732,625.50

Exercise of stock options

09/30/10

5.50

(*)

9.16

418,729 1,236,915,570 6,803,035,635.00

Exercise of stock options

10/31/10

5.50

(*)

9.68

60,235 1,236,975,805 6,803,366,927.50

Exercise of stock options

11/30/10

5.50

(*)

10.18

39,703 1,237,015,508 6,803,585,294.00

Exercise of stock options

12/31/10

5.50

(*)

8.84

321,010 1,237,336,518 6,805,350,849.00

Grant of performance shares (April 2010)

12/31/10

5.50

na

590 1,237,337,108 6,805,354,094.00

Exercise of stock options

01/31/11

5.50

(*)

9.26

207,991 1,237,545,099 6,806,498,044.50

Exercise of stock options

02/28/11

5.50

7.89

3,657 1,237,548,756 6,806,518,158.00

Exercise of stock options

03/31/11

5.50

7.89

13,971 1,237,562,727 6,806,594,998.50

Exercise of stock options

04/20/11

5.50

7.89

82,111 1,237,644,838 6,807,046,609.00

Exercise of stock options

05/31/11

5.50

7.89

1,736 1,237,646,574 6,807,056,157.00

Exercise of stock options

06/30/11

5.50

7.89

216,086 1,237,862,660 6,808,244,630.00

2011 Group Savings Plan

07/21/11

5.50

9.77

9,371,605 1,247,234,265 6,859,788,457.50

Exercise of stock options

08/31/11

5.50

7.89

2,689 1,247,236,954 6,859,803,247.00

Exercise of stock options

12/31/11

5.50

7.89

26,106 1,247,263,060 6,859,946,830.00

Bonus share award (1 for 30)

05/09/12

5.50

na

41,575,435 1,288,838,495 7,088,611,722.50

2012 Group Savings Plan

07/19/12

5.50

4.81

12,288,690 1,301,127,185 7,156,199,517.50

Exercise of stock options

07/31/12

5.50

7.46

2,000 1,301,129,185 7,156,210,517.50

Bolloré Média contributions

09/27/12

5.50

9.55

22,356,075 1,323,485,260 7,279,168,930.00

Exercise of stock options

09/30/12

5.50

7.46

8,333 1,323,493,593 7,279,214,761.50

Exercise of stock options

10/31/12

5.50

7.46

43,334 1,323,536,927 7,279,453,098.50

Exercise of stock options

11/30/12

5.50

7.46

59,411 1,323,596,338 7,279,779,859.00

Exercise of stock options

12/31/12

5.50

7.46

366,078 1,323,962,416 7,281,793,288.00

Exercise of stock options

01/31/13

5.50

7.46

144,662 1,324,107,078 7,282,588,929.00

Exercise of stock options

02/28/13

5.50

7.46

14,264 1,324,121,342 7,282,667,381.00

Exercise of stock options

03/31/13

5.50

7.46

286,362 1,324,407,704 7,284,242,372.00

Exercise of stock options

04/23/13

5.50

7.46

566,370 1,324,974,074 7,287,357,407.00

Exercise of stock options

04/30/13

5.50

7.46

27,467 1,325,001,541 7,287,508,475.50

Exercise of stock options

05/31/13

5.50

6.68

1,733,628 1,326,735,169 7,297,043,429.50

2013 Group Savings Plan

07/25/13

5.50

6.602

12,285,542 1,339,020,711 7,364,613,910.50

Exercise of stock options

10/31/13

5.50

11.91

6,861 1,339,027,572 7,364,651,646.00

Exercise of stock options

11/30/13

5.50

11.75

416,063 1,339,443,635 7,366,939,992.50

Exercise of stock options

12/31/13

5.50

11.58

166,296 1,339,609,931 7,367,854,620.50

Exercise of stock options

01/31/14

5,50

11.90

1,623,713 1,341,233,644 7,376,785,042.00

Exercise of stock options

02/28/14

5.50

11.76

733,446 1,341,967,090 7,380,818,995.00

Exercise of stock options

03/31/14

5.50

11.92

1,806.245 1,343,773,335 7,390,753,342.50

Exercise of stock options

04/30/14

5.50

12.00

937,756 1,344,711,091 7,395,911,000.50

Exercise of stock options

05/31/14

5.50

11.97

3,082,646 1,347,793,737 7,412,865,553.50

na: not applicable.

*

Weighted average premium in euros.

99

Annual Report 2014