4

Section 5 - Treasury and capital resources

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

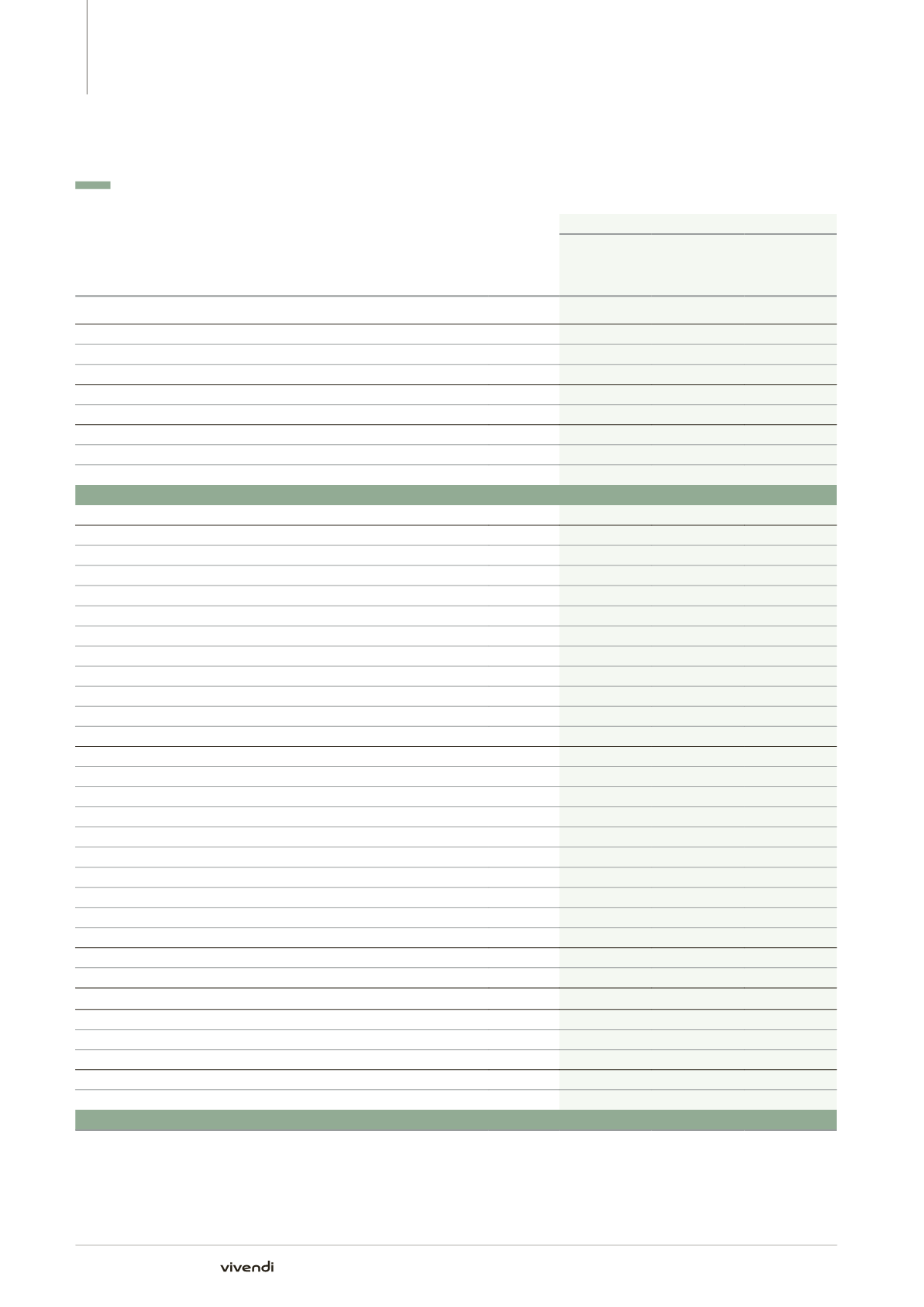

5.3. Analysis of Financial Net Debt changes

(in millions of euros)

Refer to

section

Year ended December 31, 2014

Impact

on cash

and cash

equivalents

Impact

on borrowings

and other

financial items

Impact

on Financial

Net Debt

EBIT

2

(736)

-

(736)

Adjustments

(447)

-

(447)

Content investments, net

3

(19)

-

(19)

Gross cash provided by operating activities before income tax paid

(1,202)

-

(1,202)

Other changes in net working capital

123

-

123

Net cash provided by operating activities before income tax paid

3

(1,079)

-

(1,079)

Income tax paid, net

3

(280)

-

(280)

Net cash provided by operating activities of continuing operations

(1,359)

-

(1,359)

Net cash provided by operating activities of discontinued operations

(2,234)

-

(2,234)

Operating activities

(3,593)

-

(3,593)

Financial investments

Purchases of consolidated companies, after acquired cash

100

116

216

of which investments realized by Canal+ Group

1

86

95

181

investments realized by UMG

1

14

21

35

Investments in equity affiliates

87

-

87

of which investments realized by Canal+ Group

63

-

63

investments realized by UMG

24

-

24

Increase in financial assets

1,057

-

1,057

of which cash deposit related to Vivendi’s appeal against the Liberty Media judgment

6

975

-

975

cash deposit related to Securities Class Action in the United States

6

45

-

45

Total financial investments

1,244

116

1,360

Financial divestments

Proceeds from sales of consolidated companies, after divested cash

(16,929)

(90)

(17,019)

of which cash proceeds from the sale of SFR

1

(13,366)

-

(13,366)

financing of Virgin Mobile acquisition

1

200

-

200

SFR’s net cash deconsolidated

133

(89)

44

proceeds from the sale of the 53% interest in Maroc Telecom group

1

(4,138)

-

(4,138)

Decrease in financial assets

(878)

-

(878)

of which proceeds from the sale of 41.5 million Activision Blizzard shares

1

(623)

-

(623)

proceeds from the sale of UMG’s interest in Beats

1

(221)

-

(221)

Total financial divestments

(17,807)

(90)

(17,897)

Financial investment activities

(16,563)

26

(16,537)

Dividends received from equity affiliates

(4)

-

(4)

Dividends received from unconsolidated companies

(2)

-

(2)

Net investing activities excluding capital expenditures, net

(16,569)

26

(16,543)

Capital expenditures

249

-

249

Proceeds from sales of property, plant, equipment and intangible assets

(6)

-

(6)

Capital expenditures, net

3

243

-

243

Net cash provided by/(used for) investing activities of continuing operations

(16,326)

26

(16,300)

Net cash provided by/(used for) investing activities of discontinued operations

2,034

55

2,089

Investing activities

(14,292)

81

(14,211)

Please refer to the next page for the end of this table.

182

Annual Report 2014