4

Section 4 - Business segment performance analysis

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

4.2.3.

Vivendi Village

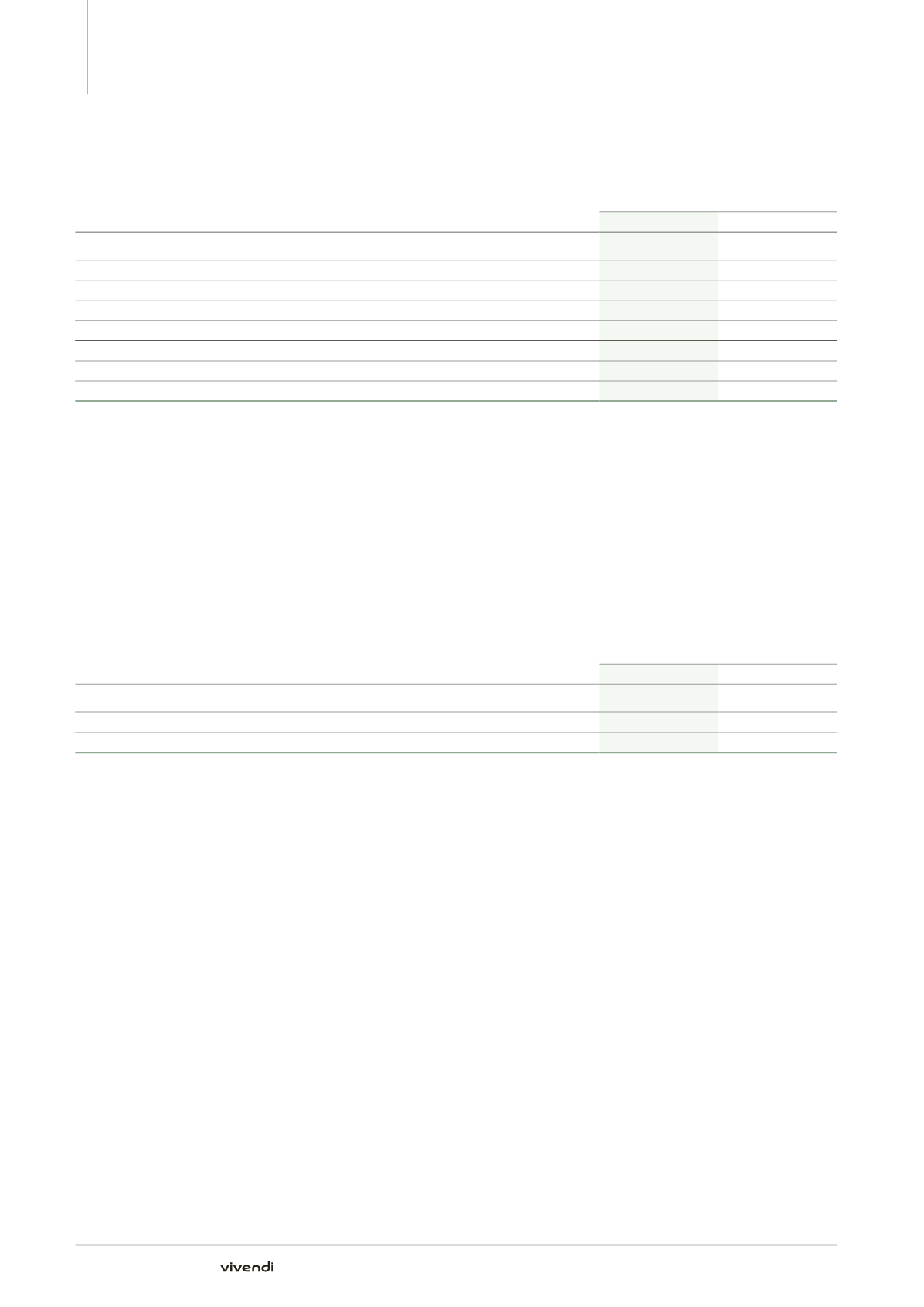

(in millions of euros)

Year ended December 31,

2014

2013

Digitick

15

13

See Tickets

36

31

Watchever

26

12

Wengo

19

15

Total Revenues

96

71

Income from operations

(34)

(78)

EBITA

(79)

(80)

Cash flow from operations (CFFO)

(44)

(80)

■

■

Revenues and EBITA

Vivendi Village’s revenues amounted to €96 million, an increase of

€25 million. It included revenues from Digitick (€15 million, compared to

€13 million in 2013), See Tickets (€36 million, compared to €31 million

in 2013), Watchever (€26 million, compared to €12 million in 2013), and

Wengo (€19 million, compared to €15 million in 2013).

Vivendi Village’s EBITA amounted to -€79 million, compared to

-€80 million in 2013. In 2014, it was notably impacted by Watchever’s

restructuring charges in Germany (-€44 million).

■

■

Cash flow from operations (CFFO)

Vivendi Village’s cash flow from operations amounted to -€44 million,

compared to -€80 million in 2013. This change was mainly related to the

change in EBITDA.

4.2.4.

Corporate

(in millions of euros)

Year ended December 31,

2014

2013

Income from operations

(82)

(87)

EBITA

(70)

(87)

Cash flow from operations (CFFO)

(69)

(89)

■

■

EBITA

Corporate EBITA was -€70 million (compared to -€87 million in 2013), an

increase of €17 million. This increase was primarily due to the decrease

in operating expenses and to non-recurring items related to pensions.

■

■

Cash flow from operations (CFFO)

Corporate’s cash flow from operations amounted to -€69 million,

compared to -€89 million in 2013. This change was mainly attributable to

the change in EBITA.

4.2.5.

GVT (discontinued operation)

GVT’s revenues were €1,765 million, a 12.8% increase at constant

currency compared to 2013. This performance was driven by continuous

growth of the core segment (retail and SME), which increased 14.1%

at constant currency; including a 56.8% year-on-year increase in pay-

TV. This service, which now represents 14.2% of GVT’s total revenues,

had 858,860 pay-TV subscribers, reflecting a 33.6% increase compared

to 2013.

GVT pursued its expansion in Brazil in a controlled and targeted manner

and launched its services in six additional cities during 2014. It now

operates in 156 cities in the South, Southeast, Midwest and Northeast

regions in Brazil.

GVT’s EBITDA was €702 million, a 8.4% increase at constant currency

compared to 2013. Its EBITDA margin reached 39.8% (41.4% for its

telecom activities alone), which is the highest margin in the Brazilian

telecom operator market.

178

Annual Report 2014