4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 9. Goodwill

■

■

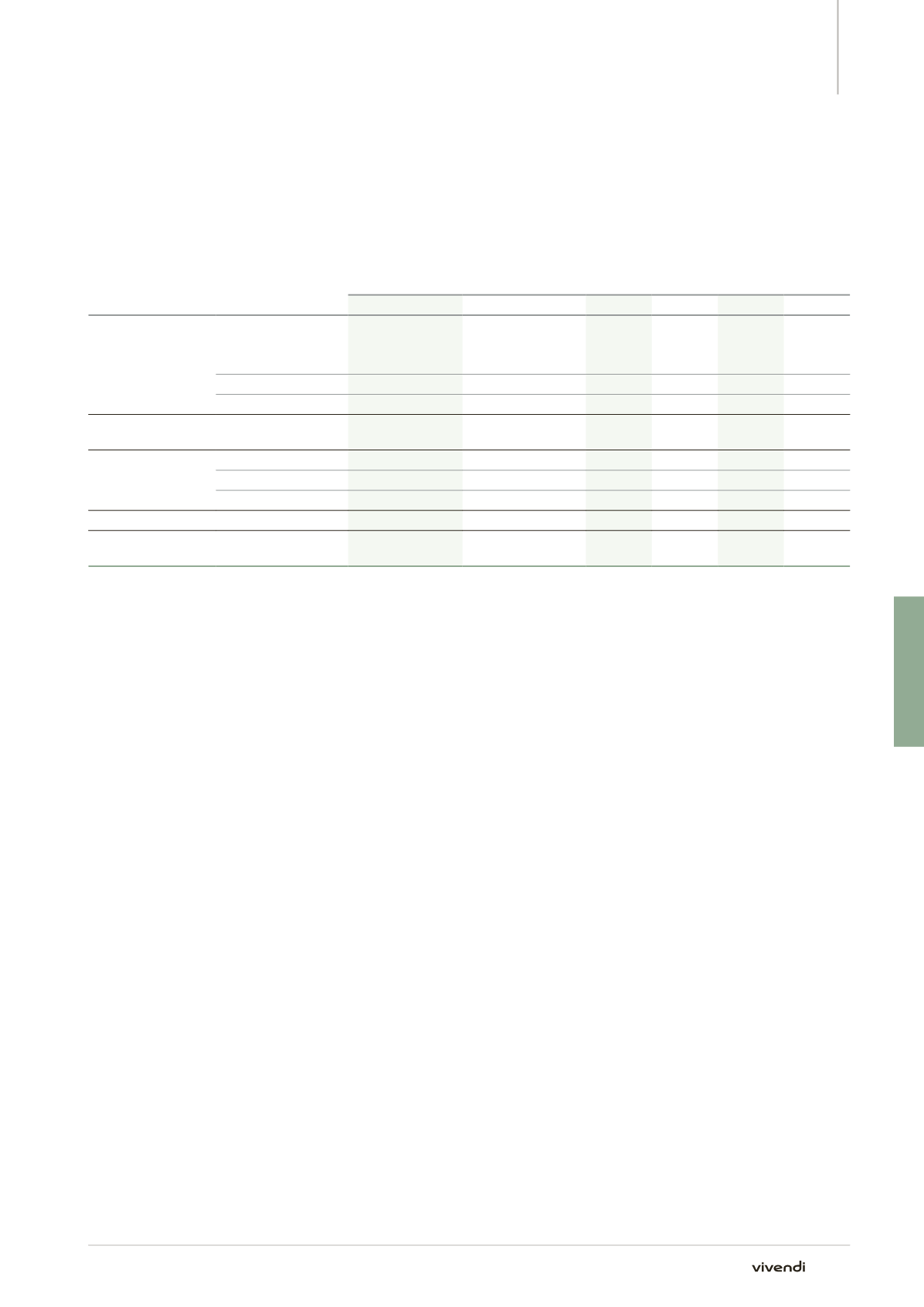

Presentation of key assumptions used for the determination of recoverable amounts

The value in use of each CGU or groups of CGU is determined as the discounted value of future cash flows by using cash flow projections consistent with

the 2015 budget and the most recent forecasts prepared by the operating segments. These forecasts are prepared for each operating segment, on the

basis of financial targets as well as the following main key assumptions: discount rate, perpetual growth rate and EBITA as defined in Note 1.2.3, capital

expenditures, the competitive and regulatory environments, technological developments and level of commercial expenses. The recoverable amount for

each CGU or groups of CGU was determined based on its value in use in accordance with the main key assumptions set out below.

Operating segments

CGU or groups

of CGU tested

Valuation method

Discount rate

(a)

Perpetual growth rate

2014

2013

2014

2013

2014

2013

Canal+ Group

Pay-TV and

free-to-air TV in France,

Africa and Vietnam

DCF &

comparables model

(b)

(c)

(d)

(e)

(f)

nc+

DCF

(g)

9.75%

(g)

3.00%

(g)

Studiocanal

DCF

DCF

9.75% 9.00% 1.00% 0.00%

Universal Music Group

Universal Music Group

DCF &

comparables model

DCF &

comparables model

8.90% 9.15% 1.00% 1.00%

Vivendi Village

See Tickets

DCF

DCF

11.50% 11.50% 2.00% 2.00%

Digitick

DCF

DCF

11.50% 11.50% 2.00% 2.00%

Wengo

DCF

DCF

13.20% 15.00% 2.00%

(h)

GVT

GVT

(i)

DCF

(i)

11.24%

(i)

4.00%

SFR

SFR

(j)

DCF &

comparables model

(j)

7.30%

(j)

0.50%

DCF: Discounted Cash Flows.

(a)

The determination of recoverable amounts using a post-tax discount rate applied to post-tax cash flows provides recoverable amounts consistent

with the ones that would have been obtained using a pre-tax discount rate applied to pre-tax cash flows.

(b)

Pay-TV in Mainland France and Canal+ Overseas: DCF & comparables model.

Free-to-air TV: DCF.

(c)

Pay-TV – Mainland France: 8.04%; France overseas: 9.04%; Africa: 10.04%; Vietnam: 10.88%.

Free-to-air TV: 9.5%.

(d)

Pay-TV – Mainland France: 8.3%; France overseas: 9.3%; Africa: 10.3%.

Free-to-air TV: 9.5%.

(e)

Pay-TV – Mainland France: 1.5%; France overseas: 1.5%; Africa: 3.14%; Vietnam: 4.5%.

Free-to-air TV: 2%.

(f)

Pay-TV – Mainland France: 1.5%; France overseas: 2.2%; Africa: 3.17%.

Free-to-air TV: 2%.

(g)

As of December 31, 2013, no goodwill impairment test in respect of nc+ (pay-TV in Poland) was undertaken given that the completion date of the

goodwill of “n”, acquired on November 30, 2012 was close to the closing date, and considering that no triggering event had occurred between those

dates.

(h)

As of December 31, 2013, the terminal value was determined by using an EBITDA multiple.

(i)

Considering the current plan to sell GVT, and in accordance with IFRS 5, GVT has been classified as a discontinued operation since the third quarter

of 2014.

(j)

SFR was sold on November 27, 2014 (please refer to Note 3.1).

243

Annual Report 2014