4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

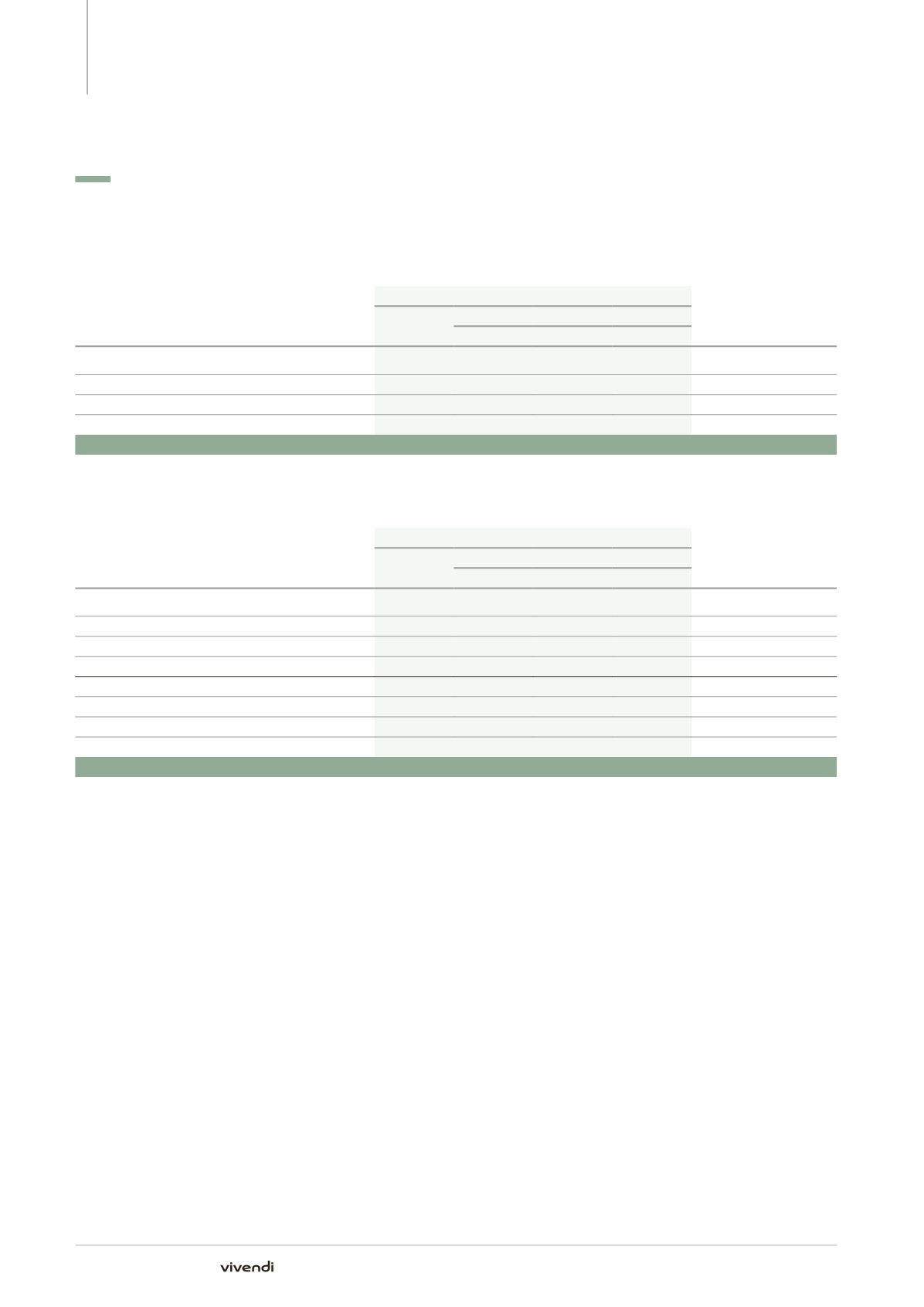

Note 10. Content assets and commitments

10.2.

Contractual content commitments

Commitments given recorded in the Statement of Financial Position: content liabilities

Content liabilities are mainly part of “Trade accounts payable and other” or part of “Other non-current liabilities” whether they are current or non-current,

as applicable (please refer to Note 15).

(in millions of euros)

Minimum future payments as of December 31, 2014

Total minimum future

payments as of

December 31, 2013

Total

Due in

2015 2016-2019 After 2019

Film and television rights

(a)

193

193

-

-

208

Sports rights

400

400

-

-

402

Music royalties to artists and repertoire owners

1,721

1,699

22

-

1,614

Creative talent, employment agreements and others

119

42

75

2

111

Content liabilities

2,433

2,334

97

2

2,335

Off-balance sheet commitments given/(received)

(in millions of euros)

Minimum future payments as of December 31, 2014

Total minimum future

payments as of

December 31, 2013

Total

Due in

2015 2016-2019 After 2019

Film and television rights

(a)

2,443

982

1,416

45

2,383

Sports rights

(b)

3,087

635

2,452

-

1,350

Creative talent, employment agreements and others

(c)

807

367

401

39

754

Given commitments

6,337

1,984

4,269

84

4,487

Film and television rights

(a)

(199)

(85)

(89)

(25)

(179)

Sports rights

(3)

(3)

-

-

(10)

Creative talent, employment agreements and others

(c)

Not available

Received commitments

(202)

(88)

(89)

(25)

(189)

Total net

6,135

1,896

4,180

59

4,298

(a)

Mainly includes contracts valid over several years for the broadcast of film and TV productions (mainly exclusivity contracts with major US studios, as

well as the license agreement entered into on March 29, 2013 in respect of the entire HBO new series, for 5 years, as of May 2013) and pre-purchase

contracts relating to the French movie industry, Studiocanal film production and co-production commitments (given and received) and broadcasting

rights of Canalsat and nc+ multichannel digital TV packages. They are recorded as content assets when the broadcast is available for initial release

or after the initial significant payment. As of December 31, 2014, provisions recorded relating to these commitments amounted to €73 million,

compared to €71 million as of December 31, 2013.

In addition, this amount does not include commitments in relation to channel right contracts, ISP (Internet Service Provider) royalties and non-

exclusive distribution of channels, under which Canal+ Group has not granted or received minimum guarantees. The variable amount of these

commitments cannot be reliably determined and is not reported in the Statement of Financial Position or in commitments and is instead recorded

as an expense for the period in which it was incurred. Based on the estimation of the future subscriber number at Canal+ Group, commitments in

relation to channel right contracts would have increased by a net amount of €342 million as of December 31, 2014, compared to €354 million as of

December 31, 2013.

Moreover, according to the agreement entered into with organizations of cinema professionals on December 18, 2009, Société d’Édition de Canal

Plus (SECP) is required to invest, every year for a five-year period (2010-2014), 12.5% of its annual revenues in the financing of European films. With

respect to audiovisual, in accordance with the agreements entered into with producers and authors’ organizations, Canal+ Group is required to invest,

in France, a percentage of its revenues in the financing of heritage work every year.

Agreements with cinema organizations and with producers and authors’ organizations are not recorded as off-balance sheet commitments as the

future estimate of these commitments cannot be reliably determined.

246

Annual Report 2014