4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

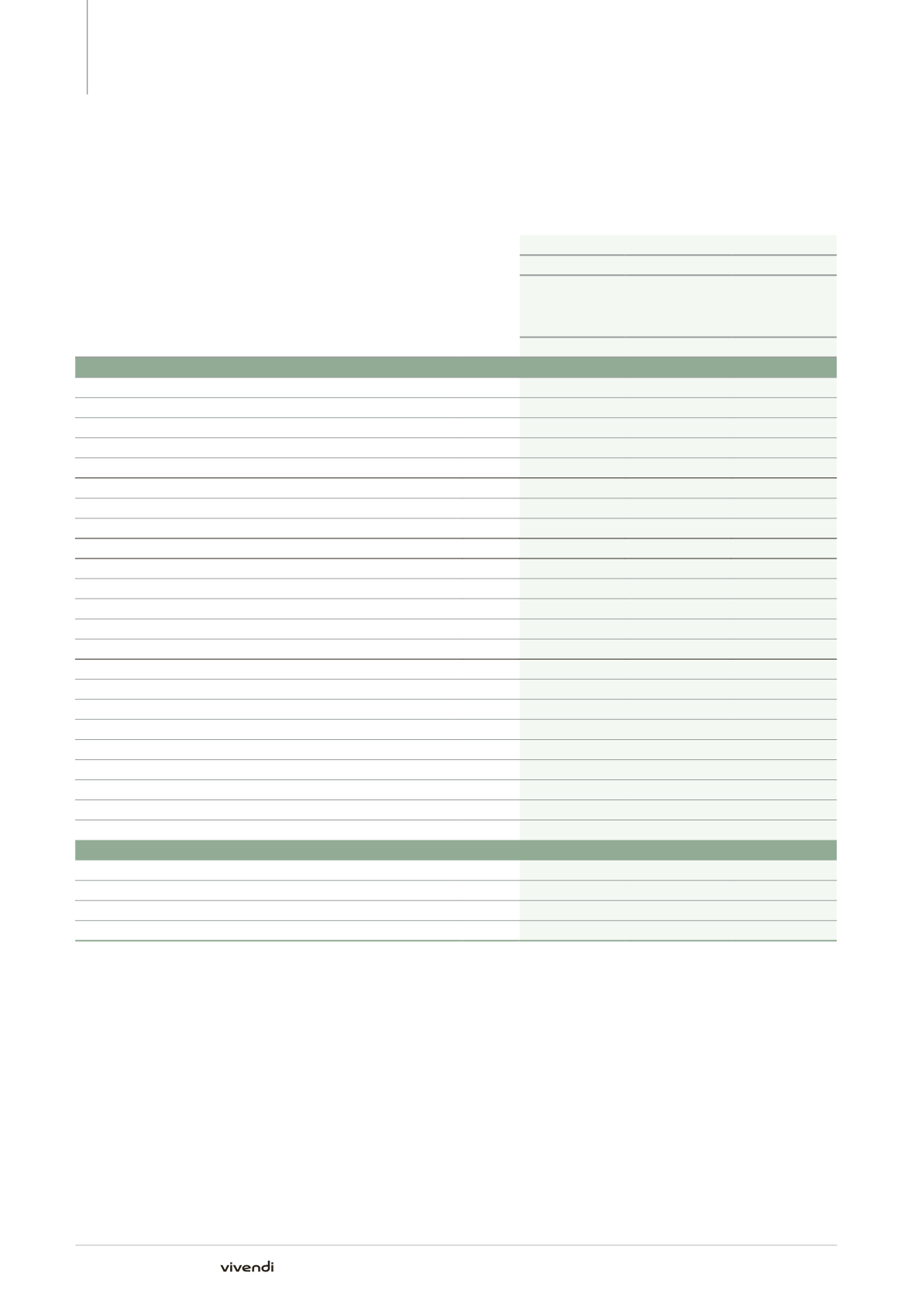

Note 19. Employee benefits

19.2.3.

Analysis of net benefit obligations with respect to pensions and post-retirement benefits

■

■

Changes in value of benefit obligations, fair value of plan assets, and funded status

(in millions of euros)

Note

Employee defined benefit plans

Year ended December 31, 2014

Benefit

obligation

Fair value

of plan assets

Net (provision)/

asset recorded in

the statement of

financial position

(A)

(B)

(B)-(A)

Opening balance

966

356

(610)

Current service cost

20

(20)

Past service cost

(26)

26

(Gains)/losses on settlements

-

(1)

(1)

Other

-

-

Impact on selling, administrative and general expenses

5

Interest cost

33

(33)

Expected return on plan assets

12

12

Impact on other financial charges and income

(21)

Net benefit cost recognized in profit and loss

(16)

Experience gains/(losses)

(a)

-

24

24

Actuarial gains/(losses) related to changes in demographic assumptions

(7)

7

Actuarial gains/(losses) related to changes in financial assumptions

122

(122)

Adjustment related to asset ceiling

-

Actuarial gains/(losses) recognized in other comprehensive income

(91)

Contributions by plan participants

1

1

-

Contributions by employers

43

43

Benefits paid by the fund

(18)

(18)

-

Benefits paid by the employer

(36)

(36)

-

Business combinations

1

-

(1)

Divestitures of businesses

(b)

(102)

-

102

Transfers

-

-

-

Other (of which foreign currency translation adjustments)

51

23

(28)

Reclassification to assets held for sale

-

-

-

Closing balance

1,005

404

(601)

of which wholly or partly funded benefits

558

wholly unfunded benefits

(c)

447

of which assets related to employee benefit plans

7

provisions for employee benefit plans

(d)

18

(608)

256

Annual Report 2014