4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 20. Share-based compensation plans

■

■

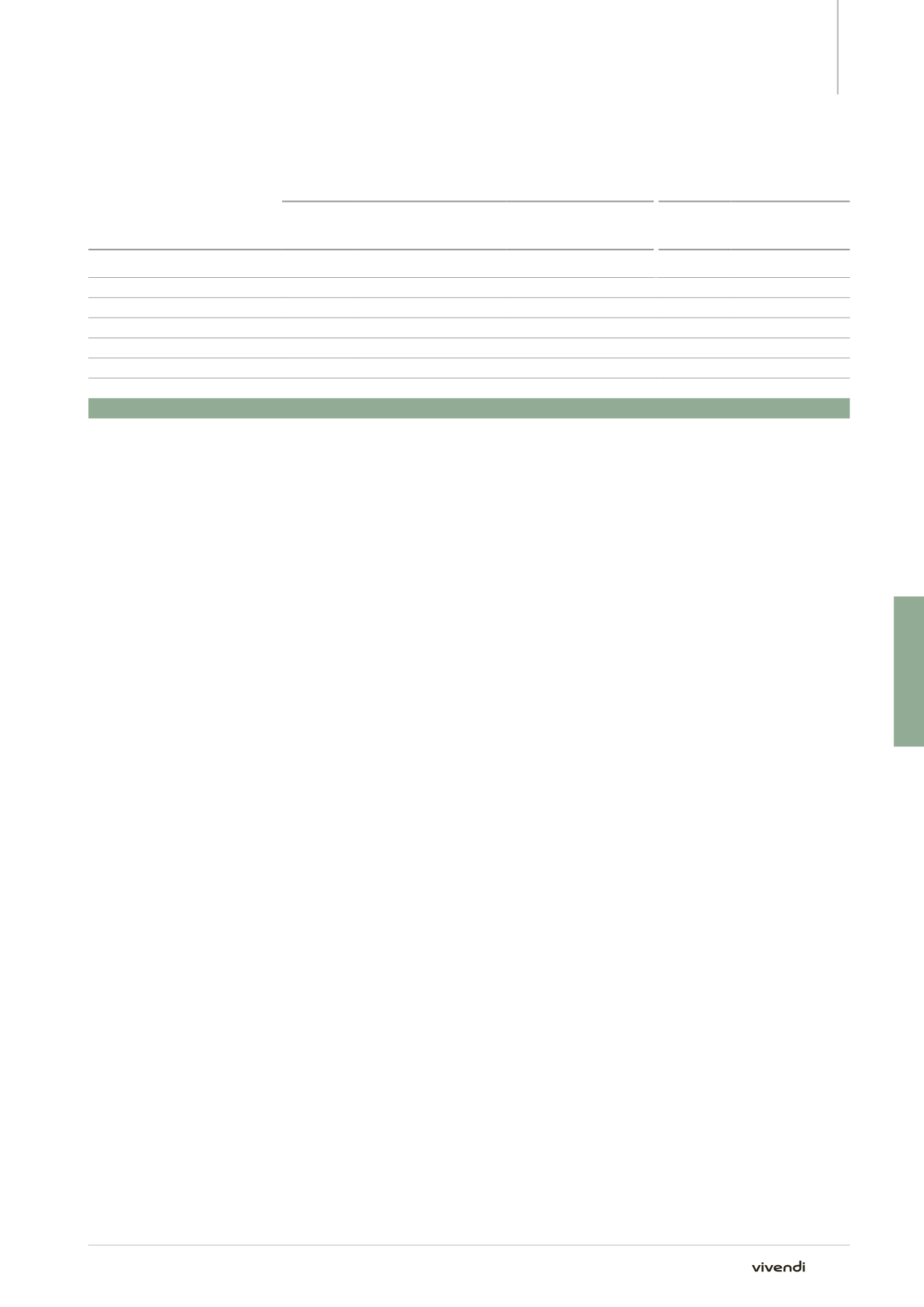

Information on stock options as of December 31, 2014

Range of strike prices

Outstanding stock options

Vested stock options

Number

(in thousands)

Weighted average strike

price

(in euros)

Weighted average

remaining contractual life

(in years)

Number

(in thousands)

Weighted average

strike price

(in euros)

Under €15

2,454

11.9

7.3

145

11.8

€15-€17

10,980

15.9

4.8

10,980

15.9

€17-€19

9,286

18.5

2.0

9,286

18.5

€19-€21

7,012

20.2

3.3

7,012

20.2

€21-€23

6,413

22.9

1.3

6,413

22.9

€23-€25

6,577

24.7

2.3

6,577

24.7

€25 and more

-

-

-

-

-

42,722

19.3

3.2

40,413

19.8

■

■

Performance share plans

In 2014, due to the changes in the scope already completed or in

progress, Vivendi did not grant any annual plan to its employees and only

granted 380,000 performance shares to a member of the Management

Board and certain Executive Officers of its subsidiaries.

On February 22, 2013, 2,573 thousand performance shares were granted.

The share price was €14.91.

After taking into account a discount for non-transferability of 8.3% of

the share price on February 22, 2013 and an expected dividend yield of

6.71%, the fair value of each granted performance share was €11.79,

corresponding to an aggregate fair value of €30 million. This value is

estimated and is set at grant date.

These rights vest at the end of a two-year period; the compensation cost

is therefore recognized on a straight-line basis over the vesting period.

Granted performance shares are then available at the end of a two-year

period. However, as the shares granted are ordinary shares of the same

class as existing shares making up the share capital of Vivendi SA,

employee shareholders are entitled to the dividends and voting rights

attached to these shares from the end of the two-year vesting period.

The recognized compensation cost corresponds to the value of the equity

instruments received by the beneficiary, and is equal to the difference

between the fair value of the shares to be received and the discounted

value of dividends that were not received over the vesting period.

The definitive grant of performance shares is subject to the satisfaction

of performance conditions. Such performance conditions include an

external indicator, therefore following the recommendations of the AFEP/

MEDEF Code. The objectives relating to the performance conditions are

determined by the Supervisory Board upon proposal by the Governance,

Nominating and Human Resources Committee.

The objectives relating to the performance conditions are assessed on a

two-year period (three-year period for plans granted since June 24, 2014).

The definitive grant is effective upon the satisfaction of the following

performance conditions:

p

p

internal indicators (with a weighting of 70%): for corporate head

office, the group’s EBITA margin and for each subsidiary, its EBITA

margin, as a function of the cumulative income from fiscal years 2013

and 2014; and

p

p

external indicators (with a weighting of 30%): performance of

Vivendi’s share price over two consecutive trading years, compared to

a basket of indices, the STOXX

®

Europe 600 Media and the STOXX

®

Europe 600 Telecommunications.

At the meeting held on February 27, 2015, after review by the Governance,

Nominating and Human Resources Committee, the Supervisory Board

approved the level of satisfaction of objectives for the cumulative fiscal

years 2013 and 2014 for the performance share plans granted in 2013.

It confirmed that not all the criteria that had been set were satisfied for

fiscal year 2014. The final grant of the 2013 performance share plans

represents, depending on the subsidiaries of the group, between 62%

and 80% of the original grant. Consequently, a portion of performance

shares granted in 2013 will be cancelled.

■

■

50 bonus share plan

On July 16, 2012, Vivendi granted a 50 bonus share per employee plan for

all the group’s French subsidiaries. 727 thousand shares were issued on

July 17, 2014 at the end of a two-year vesting period. The compensation

cost is therefore recognized on a straight-line basis over the vesting

period. These shares will only be available at the end of another two-

year period. However, as the shares granted are ordinary shares of the

same class as existing shares making up the share capital of Vivendi SA,

employee shareholders have been entitled to the dividend and voting

rights relating to these shares since July 17, 2014.

261

Annual Report 2014