4

Note 19. Items Impacting Several Items of the Statement of Financial Position

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

17.4 Borrowings maturity

As of December 31, 2014, the Group has a positive cash position. As

a reminder, the average “economic” term of the Group’s financial debt,

pursuant to which all undrawn amounts available on medium-term credit

lines may be used to reimburse the Group borrowings with the shortest

terms, was 4.2 years as of December 31, 2013.

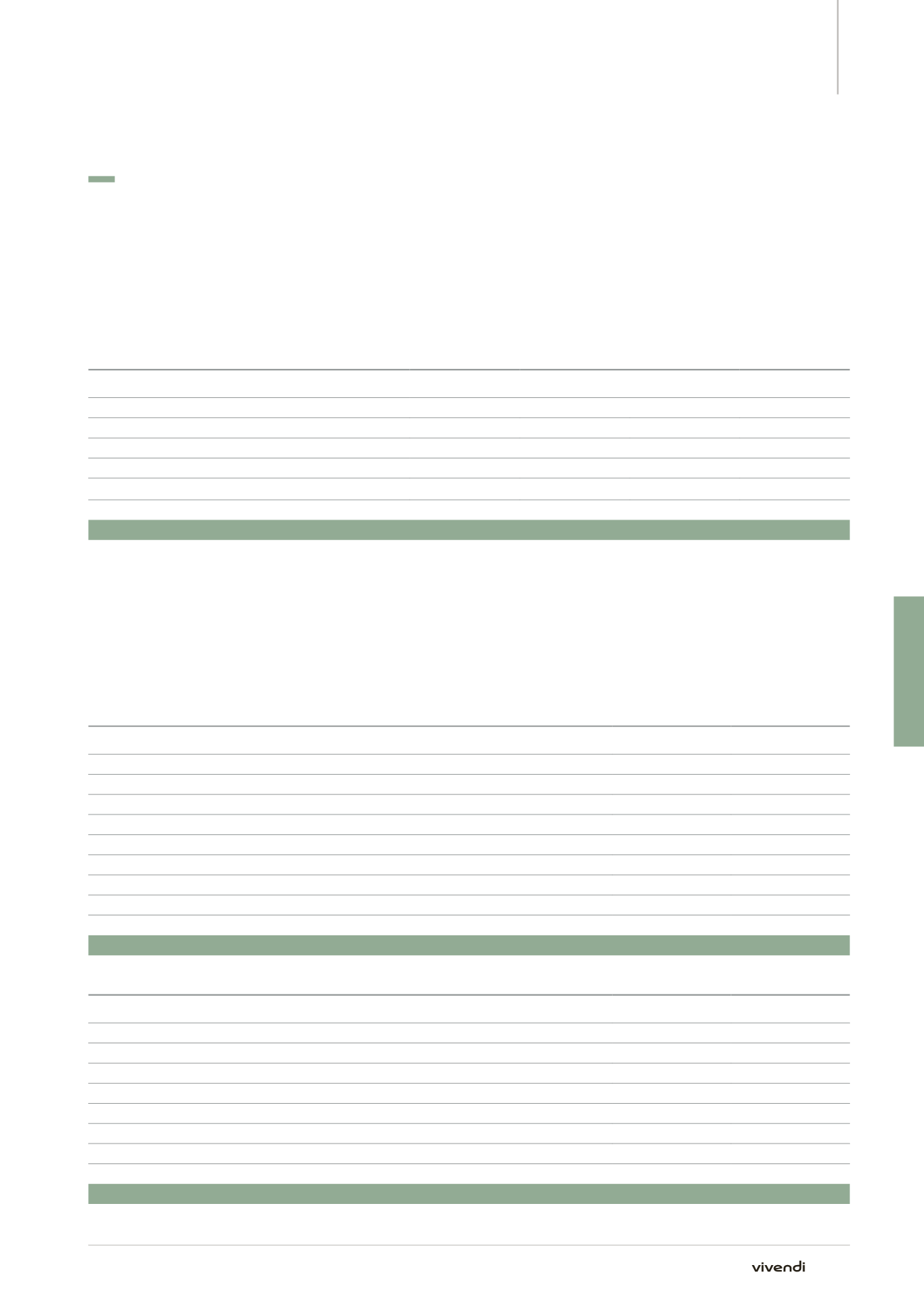

Note 18.

Debt Maturity Schedule

Liabilities (including accrued interest)

(in millions of euros)

Gross value

Due in less than

one year

Due in one to five

years

Due within more

than five years

Bond issues

1,965.3

15.3

1,950.0

Bank borrowings

334.5

334.5

Other borrowings

5,469.3

5,469.3

Trade accounts payable and related accounts

29.5

29.5

Tax and employee-related liabilities

28.4

26.5

1.9

Amounts payable in respect of PP&E and related accounts

0.1

0.1

Other liabilities

71.4

61.5

9.9

Total

7,898.5

5,936.7

1,961.8

0.0

Note 19.

Items Impacting Several Items of the Statement of Financial Position

In the table below, the “Related parties” column shows amounts

comprising various items included in the Statement of Financial

Position in relation to transactions entered into with subsidiaries fully

consolidated in the Group’s Consolidated Statement of Financial Position.

The assets in the table below are presented at gross value.

ASSETS

(in millions of euros)

Accrued income

Related parties

Investments in affiliates

18,592.8

Loans to subsidiaries and affiliates

10.6

1,370.4

Other long-term investment securities

Loans

Other long-term investments

Trade accounts receivable and related accounts

0.2

0.5

Other receivables

67.9

2,038.6

Deferred charges

Prepaid expenses

Unrealized foreign exchange losses

Total

78.7

22,002.3

LIABILITIES

(in millions of euros)

Accrued expenses

Related parties

Other bond issues

15.3

Bank borrowings

0.7

Other borrowings

5,442.7

Trade accounts payable and related accounts

26.6

2.9

Tax and employee-related liabilities

21.0

Amounts payable in respect of PP&E and related accounts

Other liabilities

9.9

Deferred income

Unrealized foreign exchange gains

Total

63.6

5,455.5

319

Annual Report 2014