4

Note 15. Stock Option Plans and Performance Share Plans

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

Note 15.

Stock Option Plans and Performance Share Plans

The main features of the plans granted during the current and prior fiscal

years are as follows (please refer to CRC Regulation no. 2008-15 on stock

purchase and subscription option plans and performance share plans

granted to employees):

15.1. Stock subscription option plans

No stock option plans were awarded during 2013 or 2014.

In 2013, the Supervisory Board, upon the proposal of the Management

Board and the advice of the Human Resources Committee, decided to

stop granting stock option plans.

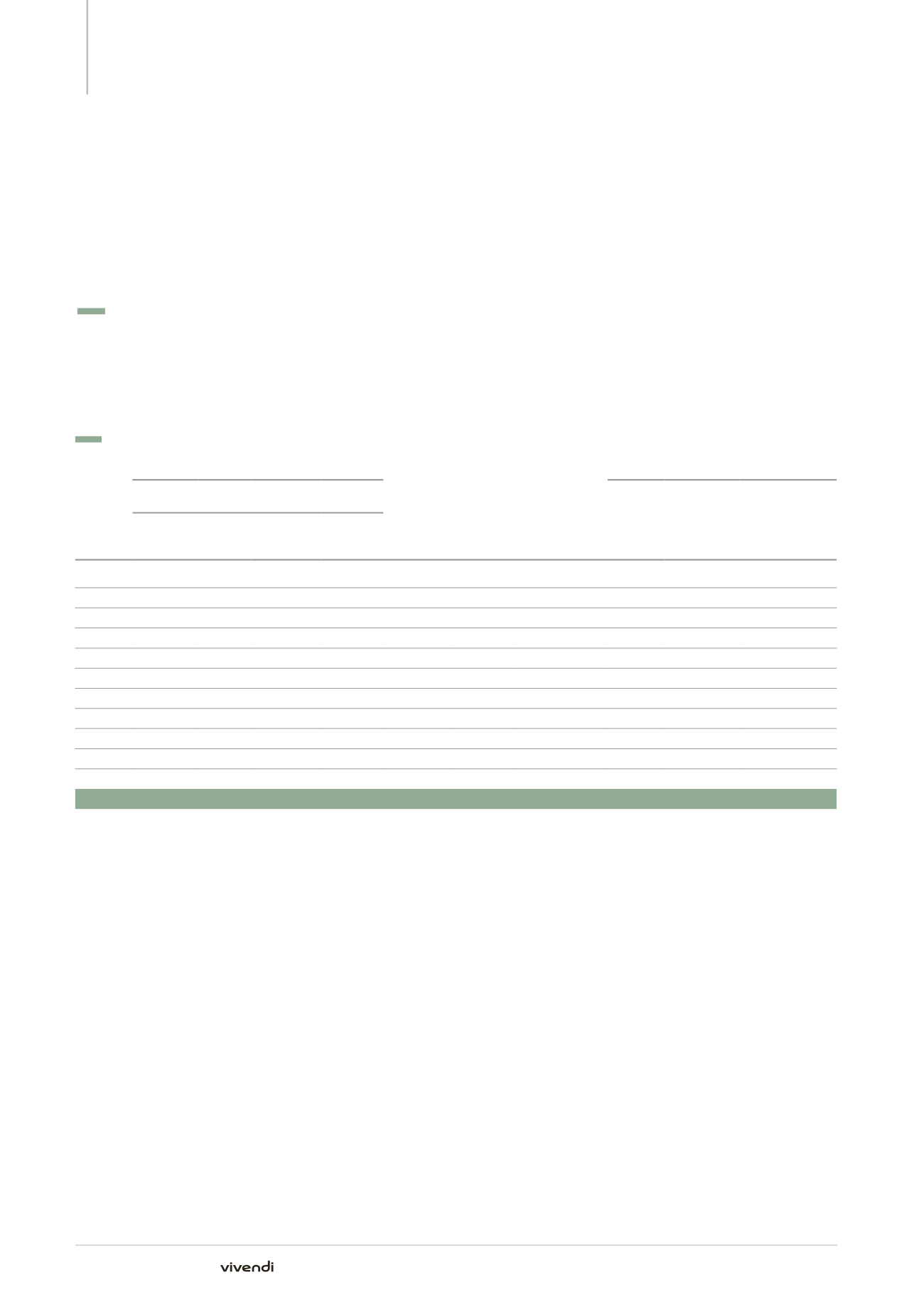

15.2. Performance share plans

Grant date

Number of performance share rights granted

(1)

Vesting

date

Availability

date

Value of shares for

the calculation of the

social contribution

Number of performance share rights

Total number of

of which granted tomembers

of governing bodies

Number of

performance

share rights

cancelled

in 2014

Number of

shares created

at the end of the

vesting period

Number of

performance share

rights outstanding at

Dec. 31, 2014 after

adjustments

beneficiaries

perfor-

mance

share rights

Number of

beneficiaries

Number of

performance

share rights

02/22/13

775 2,573,444

8

360,000

02/23/15

02/24/17

11.79

165,344

(a)

2,609,788

05/13/13

9

8,190

0

0

05/14/15

05/15/17

13.58

9,202

06/18/13

2

26,390

0

0

06/19/15

06/20/17

11.87

27,830

07/22/13

5

47,816

0

0

07/23/15

07/24/17

12.35

2,704

(b)

47,577

10/21/13

3

56,000

1

20,000

10/22/15

10/23/17

15.64

59,069

12/11/13

1

70,000

1

70,000

12/14/15

12/15/17

14.33

73,827

01/29/14

1 100,000

0

0

01/01/17

01/31/18

15.59

(c)

105,462

01/29/14

1

50,000

0

0

01/02/19

01/03/19

14.91

(d)

52,731

01/29/14

1 100,000

0

0

01/30/16

01/31/18

15.81

(e)

105,462

02/19/14

1

30,000

0

0

02/22/16

02/23/18

16.92

31,644

02/21/14

1 100,000

1

100,000

02/22/16

02/23/18

17.13

105,497

Total

168,048

0

3,228,089

(1)

First trading day of quotation at the end of a two-year acquisition period.

(a)

Includes 473,848 rights to performance shares, after adjustments, granted to US, British and Brazilian resident beneficiaries to be recorded in an

account in 2017.

(b)

Includes 15,938 rights to performance shares, after adjustments, granted to British and Brazilian resident beneficiaries to be recorded in an account

in 2017.

(c)

Includes 105,462 rights to performance shares, after adjustments, granted to a Brazilian resident beneficiary to be recorded in an account in 2018.

(d)

Includes 52,731 rights to performance shares, after adjustments, granted to a Brazilian resident beneficiary to be recorded in an account in 2019.

(e)

Includes 105,462 rights to performance shares, after adjustments, granted to a US resident beneficiary to be recorded in an account in 2018.

The definitive grant of performance shares for plans granted in 2013

will be effective upon the satisfaction of the following performance

conditions: (i) an internal indicator (70%) determined by the applicable

EBITA margin rate, measured as of December 31, 2014 on a cumulative

basis including the 2013 and 2014 fiscal years; and (ii) an external

indicator (30%) determined by the performance of Vivendi shares

between January 1, 2013 and December 31, 2014, as compared to: the

STOXX

®

Europe 600 Telecommunications Index (70%) and the value of a

portfolio of Media stock (30%).

The definitive grant of performance shares for plans granted in 2014

will be effective upon the satisfaction of the following performance

conditions: (i) an internal indicator (70%) determined by the applicable

EBITA margin rate, which will be measured as of December 31, 2015 on

a cumulative basis including the 2014 and 2015 fiscal years; and (ii) an

external indicator (30%) determined by Vivendi’s stock price performance

between January 1, 2014 and December 31, 2105, as compared to two

indices: the STOXX

®

Europe 600 Media and the STOXX

®

Europe 600

Telecommunications.

The definitive grant of performance shares will be effective upon the

satisfaction of the performance conditions, as assessed at the end of

a two-year acquisition period. 100% of the performance shares granted

will vest if the weighted total of the three indicators reaches or exceeds

100%, 50% of the performance shares granted will vest if the weighted

total of the indicators reaches the applicable value thresholds, and no

shares will vest if the weighted total of the three indicators is lower than

the applicable value thresholds. Performance shares must be retained by

their holders for an additional two-year period following the vesting date.

316

Annual Report 2014