4

Note 27. Foreign Currency Risk Management

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

Note 26.

Instruments Used toManage Borrowings

Vivendi manages its financial liquidity, interest rate and foreign

currency exchange rate risks centrally. Vivendi’s Financing and Treasury

Department conducts these operations, reporting directly to the Chief

Financial Officer of Vivendi, who is also a member of the Management

Board. The Financing and Treasury Department has the necessary

expertise, resources (in particular, technical resources) and information

systems for this purpose.

Vivendi uses various derivative financial instruments to manage and

reduce its exposure to fluctuations in interest rates and foreign currency

exchange rates. All instruments are traded over-the-counter with highly-

rated counterparties.

The majority of Group financing is secured directly by Vivendi SA, which

provides financing to its subsidiaries as and when necessary.

As of December 31, 2014, Vivendi SA’s open swaps, which qualify for

hedge accounting, totaled €3.1 billion and can be summarized as follows:

p

p

€450 million of fixed-rate payer swaps, issued in 2012 with a maturity

date of 2017;

p

p

€450 million of fixed-rate receiver swaps, issued in 2010 with a

maturity date of 2017; and

p

p

€1,000 million of fixed-rate receiver swaps, issued in 2011 with a

maturity date of 2016.

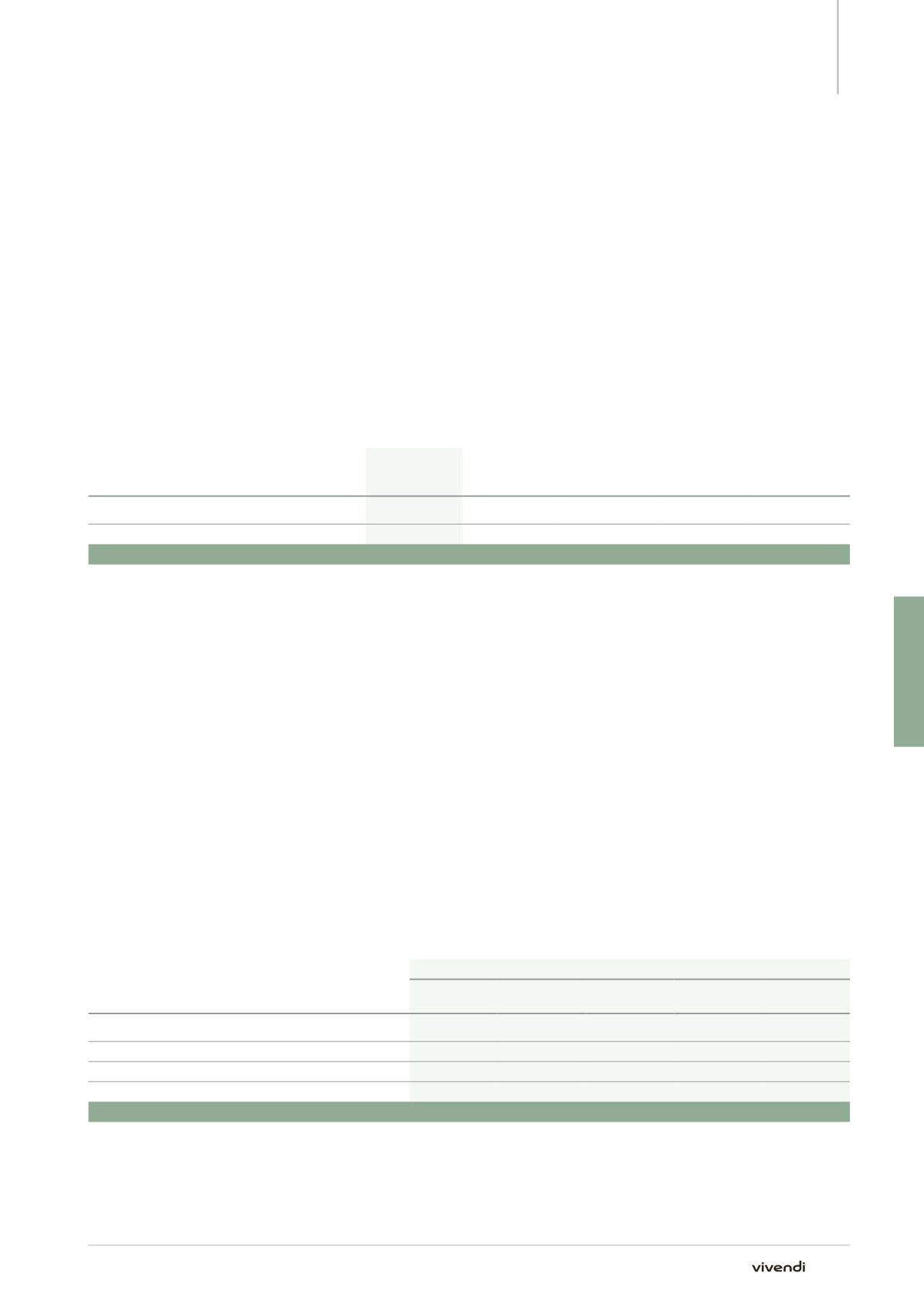

Instruments held by Vivendi SA to hedge borrowings are broken-down as follows:

Vivendi SA External Hedging Arrangements

(in millions of euros)

12/31/14

Maturing

within < 1 year

Maturing

within

1 to 5 years

Maturing

within

> 5 years Counterparty

Fixed-rate receiver swaps

1,450

1,450

Banks

Fixed-rate payer swaps

450

450

Banks

Total

1,000

0

1,000

0

As of December 31, 2014, there was no interest rate internal hedging between Vivendi SA and its subsidiaries.

Note 27.

Foreign Currency RiskManagement

Vivendi’s foreign currency risk management seeks to hedge highly

probable budget exposures, resulting primarily from monetary flows

generated by operations performed in currencies other than the euro, and

from firm commitment contracts, essentially in relation to the acquisition

by subsidiaries of editorial content including sports, audiovisual and film

rights, realized in foreign currencies. It should be noted that:

p

p

Vivendi SA is the sole counterparty for foreign currency transactions

within the Group, unless specific regulatory or operational restrictions

require otherwise; and

p

p

all identified exposures are hedged at a minimum of 80% for

exposures related to forecasted transactions, and 100% for firm

commitment contracts.

In addition, Vivendi may also hedge foreign currency exposure resulting

from foreign currency-denominated financial assets and liabilities

by entering into currency swaps and forward contracts, enabling the

refinancing or investment of cash balances in euros or other local

currencies, and use monetary or derivative instruments, if applicable, to

manage its foreign currency exposure to inter-company current accounts

denominated in foreign currencies (which qualify for hedge accounting

pursuant to the French PCG).

The table below shows the notional amount of currency to be delivered

or received under currency instruments (currency swaps and forward

contracts). Positive amounts indicate currency receivable and negative

amounts currency deliverable.

(in millions of euros)

December 31, 2014

EUR

GBP

PLN

USD

Other

currencies

Sales against the euro

1,176

(1,061)

(52)

(63)

Sales against other currencies

3

56

(59)

Purchases against the euro

(1,908)

1,020

51

717

120

Purchases against other currencies

57

(3)

(56)

3

(1)

(675)

(41)

(5)

724

(3)

329

Annual Report 2014