4

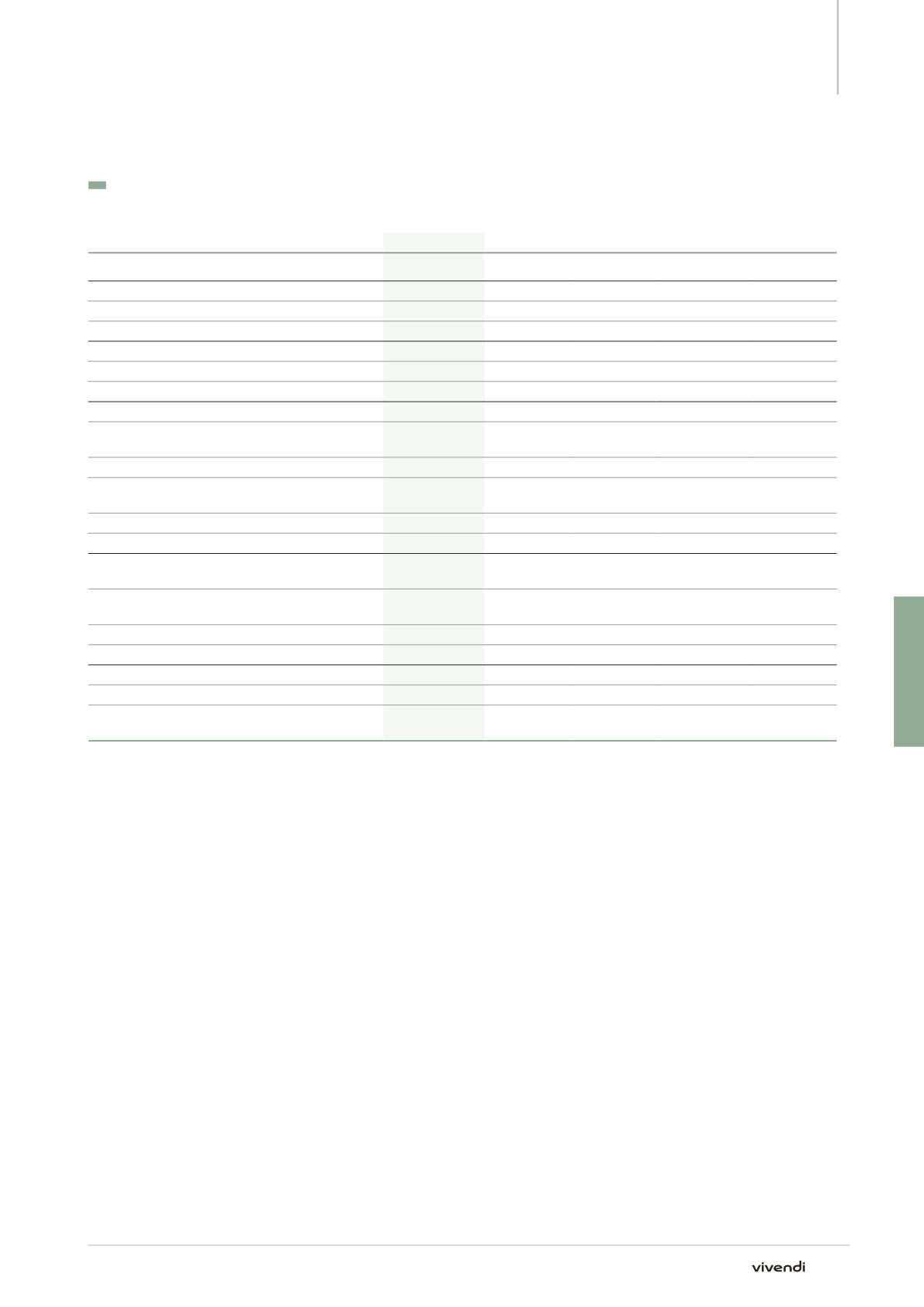

Financial Results of the Last Five Years

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

6. Financial Results of the Last Five Years

(in millions of euros)

2014

2013

2012

2011

2010

Share capital at the end of the year

Share capital

7,433.8

7,367.8

7,281.8

6,859.9

6,805.4

Number of shares outstanding

(a)

1,351,600,638 1,339,609,931 1,323,962,416 1,247,263,060 1,237,337,108

Potential number of shares created by

Exercise of stock subscription options

42,722,348

52,835,330

53,405,701

49,907,071

48,921,919

Grant of bonus shares or performance shares

(b)

0

(b)

663,050

(b)

696,700

2,960,562

1,826,639

Results of operations

Revenues

58.3

94.6

116.0

100.3

92.0

Earnings/(loss) before tax, depreciation, amortization

and provisions

(8,023.4)

512.7

734.4

(1,030.0)

(506.7)

Income tax expense/(credit)

(c)

(202.0)

(c)

(387.1)

(c)

(955.7)

(c)

(418.5)

(c)

(658.9)

Earnings/(loss) after tax, depreciation, amortization

and provisions

2,914.9

(4,857.6)

(6,045.0)

1,488.4

2,276.7

Earnings distributed

(g)

1,351.6

-

(f)

(d)

1,324.9

(d)

1,245.3

(d)

1,730.7

Per share data

(in euros)

Earnings/(loss) after tax but before depreciation,

amortization and provisions

(e)

(5.79)

0.67

1.28

(0.49)

0.12

Earnings/(loss) after tax, depreciation, amortization

and provisions

(e)

2.16

(3.63)

(4.57)

1.19

1.84

Dividend per share

(g)

1.00

-

(f)

(d)

1.00

(d)

1.00

(d)

1.40

Employees

Number of employees (annual average)

194

214

222

219

214

Payroll

58.1

36.8

41.3

35.7

36.4

Employee benefits (social security contributions,

social works, etc.)

20.4

18.6

18.4

16.0

16.2

(a)

Includes account movements up to December 31, 2014: issuance of (i) 727,118 shares in respect of Group Savings Plans (see (b) below);

and (ii) 11,263,589 shares following the exercise of stock subscription options by beneficiaries.

(b)

Grant of 50 bonus shares to each employee of the Group’s French entities on July 16, 2014.

(c)

This negative amount represents the income generated pursuant to the Consolidated Global Profit Tax System under Article 209

quinquies

of the

General Tax Code plus the tax saving recorded by the tax group headed by Vivendi.

(d)

Based on the number of shares entitled to dividends as of January 1, after deduction of treasury shares at the dividend payment date.

(e)

Based on the number of shares at year-end (see (a) above).

(f)

On June 30, 2014, Vivendi SA paid an ordinary distribution of €1 per share, from additional paid-in capital for an aggregate amount of €1,347.7 million

considered as a return of capital.

(g)

This dividend corresponds to the €1 euro per share that will be proposed at the General Shareholders’ Meeting to be held on April 17, 2015. It is

calculated based on the number of shares outstanding on December 31, 2014 and will be adjusted to reflect the actual number shares entitled to

the dividend on the ex-dividend date.

333

Annual Report 2014