4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 22. Financial instruments and management of financial risks

Note 22.

Financial instruments and management of financial risks

22.1.

Fair value of financial instruments

Financial instruments, as assets under Vivendi’s Statement of Financial

Position, include financial assets measured at fair value and at historical

cost, trade accounts receivable and other, as well as cash and cash

equivalents. As liabilities, they include bonds and bank credit facilities,

other financial liabilities (including commitments to purchase non-

controlling interests), as well as trade accounts payable and other non-

current liabilities. In addition, financial instruments include derivative

instruments (assets or liabilities).

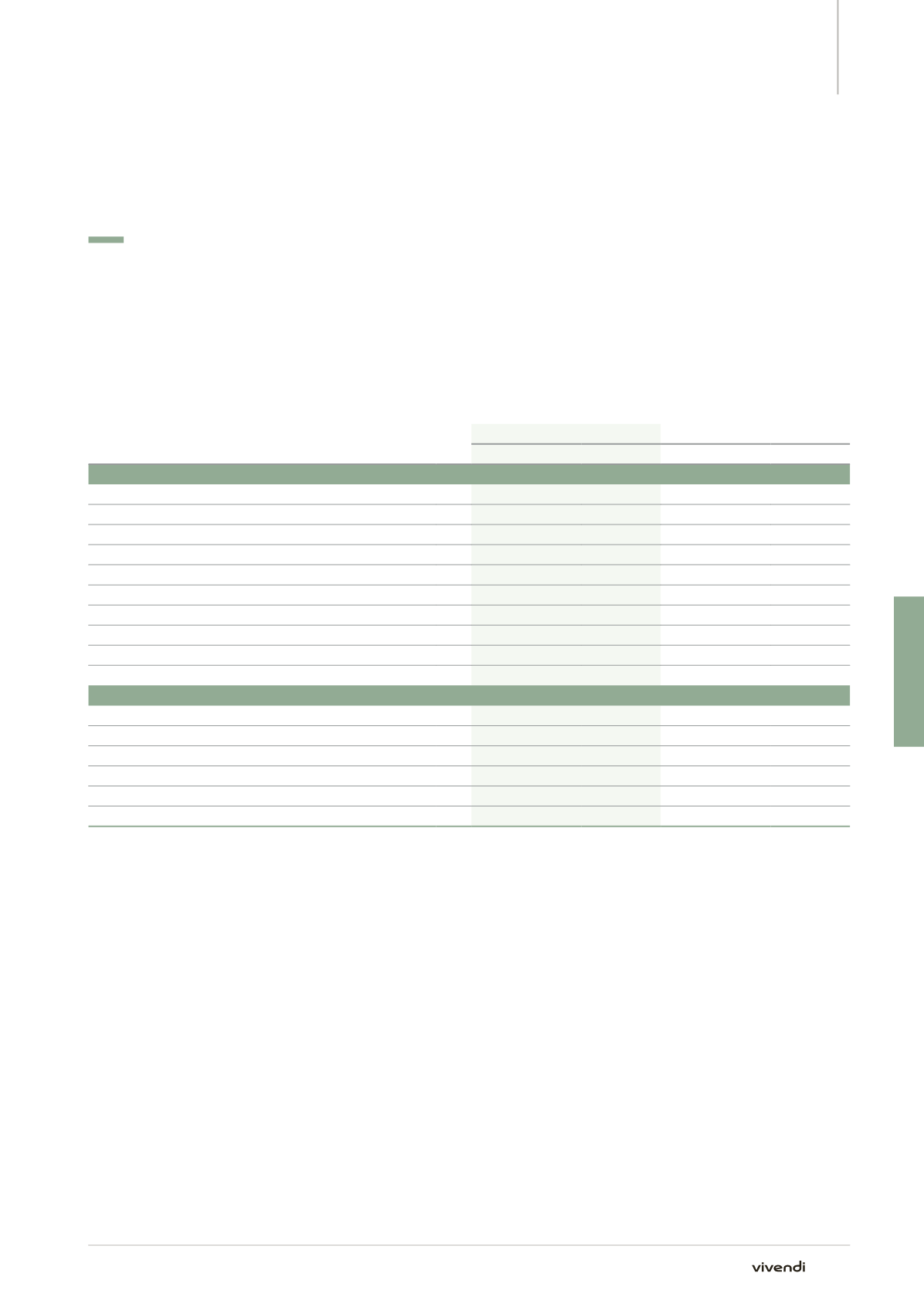

Accounting category and fair value of financial instruments

(in millions of euros)

Note

December 31, 2014

December 31, 2013

Carrying value Fair value

Carrying value Fair value

Assets

Available-for-sale securities

4,881

4,881

360

360

Derivative financial instruments

139

139

126

126

Other financial assets at fair value through profit or loss

13

13

5

5

Financial assets at amortized cost

1,160

1,160

208

208

Financial assets

14

6,193

6,193

699

699

Trade accounts receivable and other, at amortized cost

15

1,983

1,983

4,898

4,898

Cash

240

na

525

na

Term deposits and interest-bearing current accounts

1,851

na

470

na

UCITS

4,754

4,754

46

46

Cash and cash equivalents

16

6,845

4,754

1,041

46

Liabilities

Borrowings, at amortized cost

2,227

2,483

12,218

12,721

Derivative financial instruments

33

33

26

26

Commitments to purchase non-controlling interests

87

87

22

22

Borrowings and other financial liabilities

21

2,347

2,603

12,266

12,769

Other non-current liabilities, at amortized cost

121

121

757

757

Trade accounts payable and other, at amortized cost

15

5,306

5,306

10,416

10,416

na: not applicable.

Valuation method for financial instruments at fair value

The following tables show the fair value method of financial instruments according to the three following levels:

p

p

Level 1

: fair value measurement based on quoted prices in active markets for identical assets or liabilities;

p

p

Level 2

: fair value measurement based on observable market data (other than quoted prices included within Level 1); and

p

p

Level 3

: fair value measurement based on valuation techniques that use inputs for the asset or liability that are not based on observable market data.

As a reminder, the other financial instruments at amortized cost are not included in the following tables.

267

Annual Report 2014