4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

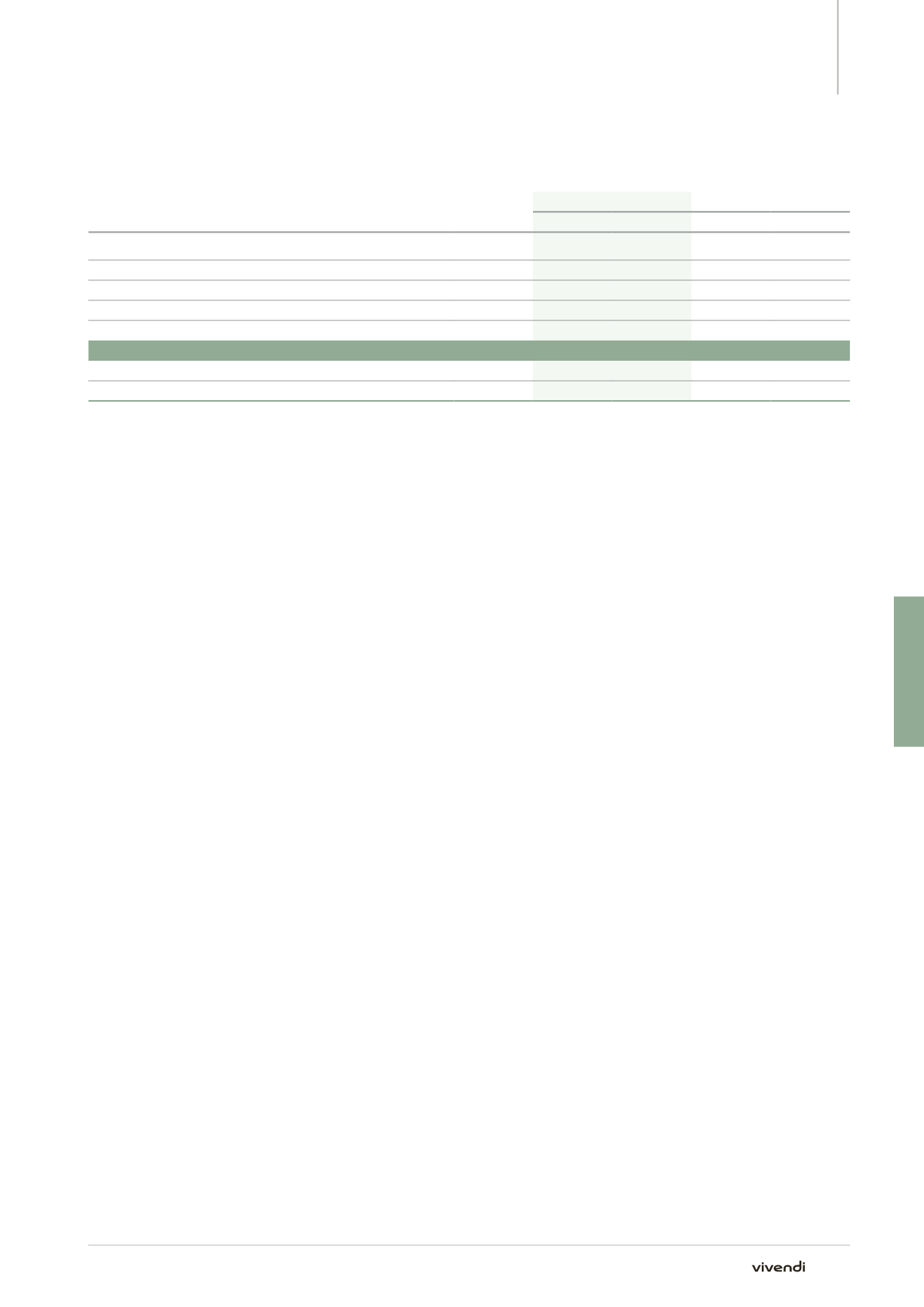

Note 22. Financial instruments and management of financial risks

Derivative financial instrument values on the Statement of Financial Position

(in millions of euros)

Note

December 31, 2014

December 31, 2013

Assets

Liabilities

Assets

Liabilities

Interest rate risk management

22.2.3

75

(12)

88

(7)

Pay-fixed interest rate swaps

-

(12)

-

(7)

Pay-floating interest rate swaps

75

-

88

-

Foreign currency risk management

22.2.4

43

(21)

17

(19)

Other

21

-

21

-

Derivative financial instruments

139

(33)

126

(26)

Deduction of current derivative financial instruments

(40)

21

(17)

19

Non-current derivative financial instruments

99

(12)

109

(7)

22.2.1.

Investment risk and counterparty risk management

Vivendi’s policy for investments mainly aims to minimize its exposure

to counterparty risk. Consequently, Vivendi is mainly committed

within highly rated mutual funds and commercial banks, and allocates

investments among selected banks and limits the amount of each such

investment.

As of December 31, 2014, outstanding cash and cash equivalents of

Vivendi amounted to €6,845 million, of which €6,524 million is held by

Vivendi SA and invested in the following financial institutions with at

least an A2/A rating:

p

p

€4,754 million in ten UCTIS monetary funds, managed by five

management companies; and

p

p

€1,770 million in term deposits and interest-bearing current accounts

within eight banks. Term deposits with initial maturities greater than

three months contain an option to terminate at any time and present

an insignificant risk of changing in value.

As of December 31, 2014, the average interest rate on Vivendi’s

investments was 0.49%.

In addition, Vivendi does not consider there to be a significant risk of

non-recovery of trade accounts receivable for its business operations:

the large individual customer base, the broad variety of customers and

markets, as well as the geographic diversity of its business operations

(mainly Canal+ Group and Universal Music Group) enable to minimize the

risk of credit concentration related to trade accounts receivable.

22.2.2.

Equity market value risk management

Vivendi’s cash investment policy prohibits equity investments. However,

following divestiture or acquisition, Vivendi may hold non-consolidated

interests as part of an opportunist strategy in more or less long term.

As of December 31, 2014, Vivendi held shares in the following listed

companies, recognized as “Available-for-sale securities” in the

Consolidated Statement of Financial Position, for an aggregate amount

of €4,676 million:

p

p

97.4 million Numericable-SFR shares, i.e., a 20% interest held

following the sale of SFR to Numericable Group on November 27,

2014, valued at €3,987 million as of December 31, 2014. These

shares are notably subject to a lock-up provision: please refer to

Note 3.1; and

p

p

41.5 million Activision Blizzard shares valued at €689 million as of

December 31, 2014. These shares were subject to a lock-up provision,

which matured on January 7, 2015: please refer to Note 3.4.

Vivendi is thus exposed to the risk of fluctuation in the value of these

shares. As of December 31, 2014, the unrealized gain with respect to

these shares amounted to €1,015 million, directly recognized in equity.

An unfavorable and uniform change of 10% in all of these shares would

have a negative impact of €468 million on Vivendi’s equity.

In addition, Canal+ Group holds 95 million shares in TVN (free-to-air TV

in Poland) indirectly held by N-Vision and consolidated under the equity

method by Canal+ Group. On October 16, 2014, Canal+ Group and ITI

Group announced they were jointly considering strategic options in

respect of their interest in TVN (please refer to Note 13).

Finally, as part of the plan to sell GVT, which is expected to be completed

during the second quarter of 2015 (please refer to Note 3.2), Vivendi

should receive Telefonica Brasil (VIVO/GVT) and Telecom Italia shares,

valued at €1,830 million and €960 million, respectively, based on the

stock market price and currency exchange rate on August 28, 2014

(starting date of the exclusive negotiations with Telefonica), representing

an aggregate amount of €2.8 billion.

269

Annual Report 2014