4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

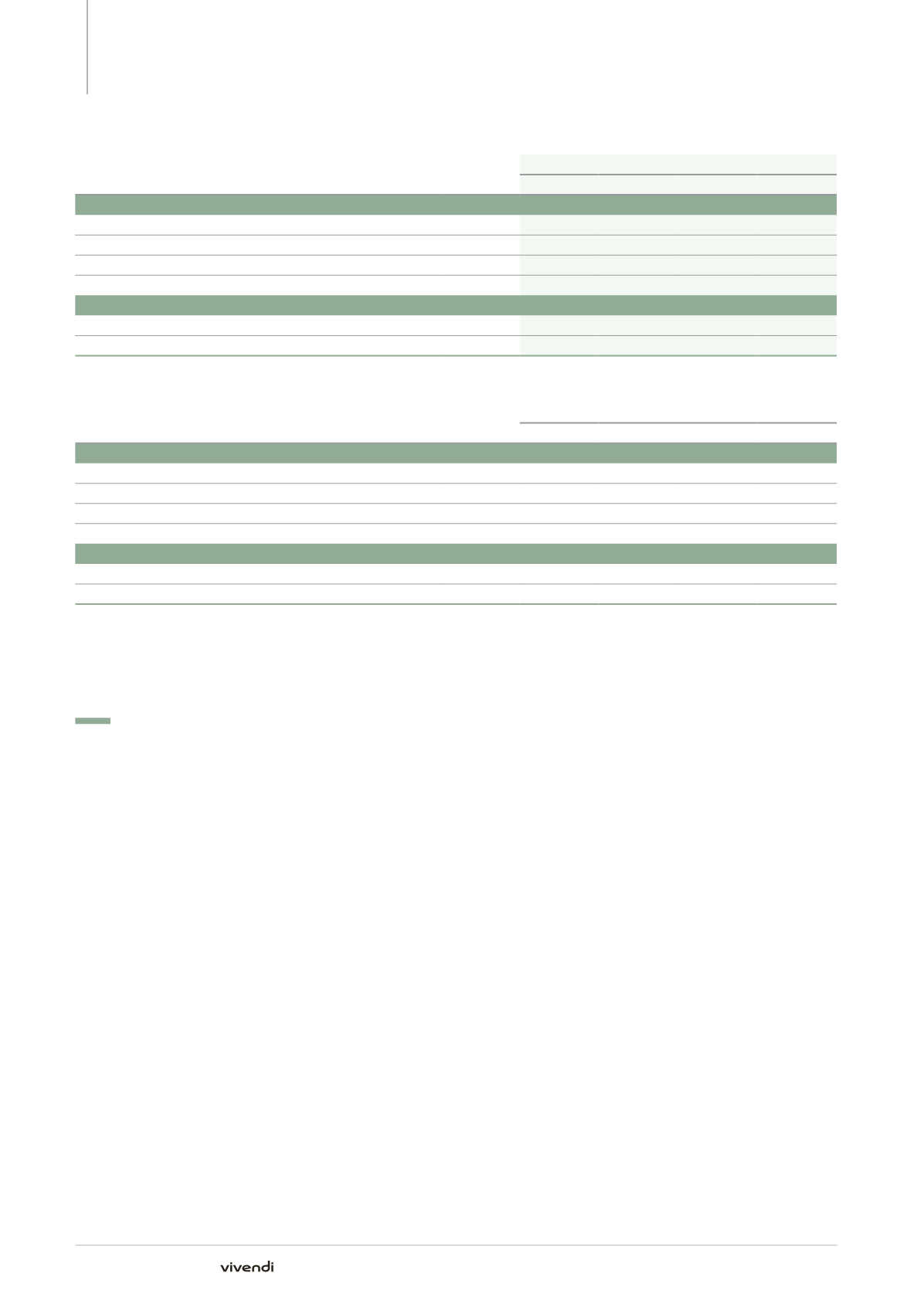

Note 22. Financial instruments and management of financial risks

(in millions of euros)

Note

December 31, 2014

Total

Level 1

Level 2

Level 3

Assets

Available-for-sale securities

(a)

14

4,881

4,676

162

43

Derivative financial instruments

22.2

139

-

139

-

Other financial assets at fair value through profit or loss

13

5

-

8

UCITS

16

4,754

4,754

-

-

Liabilities

Commitments to purchase non-controlling interests

87

-

-

87

Derivative financial instruments

22.2

33

-

33

-

(a)

As of December 31, 2014, available-for-sale securities primarily included securities held by Vivendi, valued on stock market price at that date: an

interest in Numericable-SFR for €3,987 million and an interest in Activision Blizzard for €689 million.

(in millions of euros)

Note

December 31, 2013

Total

Level 1

Level 2

Level 3

Assets

Available-for-sale securities

14

360

-

304

56

Derivative financial instruments

22.2

126

-

126

-

Other financial assets at fair value through profit or loss

5

5

-

-

UCITS

16

46

46

-

-

Liabilities

Commitments to purchase non-controlling interests

22

-

-

22

Derivative financial instruments

22.2

26

-

26

-

In 2014 and 2013, there was no transfer of financial instruments

measured at fair value between level 1 and level 2. In addition, as of

December 31, 2014 and December 31, 2013, financial instruments

measured at level 3 fair value did not include any significant amount.

22.2.

Management of financial risks

As part of its business, Vivendi is exposed to several types of financial

risks: market risks, credit risks, counterparty risks, as well as liquidity

risks. Market risks notably include interest rate risks, foreign currency

risks and equity market value risks. Vivendi’s Financing and Treasury

Department centrally manages financial risks for the group and its

subsidiaries, reporting directly to Vivendi’s Chief Financial Officer. The

Department has the necessary expertise, resources (notably technical

resources), and information systems for this purpose. The Treasury

Committee monitors, on a bi-monthly basis, the liquidity positions in

all business units and the exposure to main financial risks, in particular

counterparty risk, equity market value risks as well as foreign currency

risks and interest rate risks. Finally, short- and long-term financing

activities are performed at the group’s headquarters and are subject to

the prior approval of the Management Board and Supervisory Board, in

accordance with the provisions of their Internal Regulations.

As of December 31, 2014, the financial position of Vivendi may be

summed up as follows:

p

p

due to the sale of 88% of Vivendi’s interest in Activision Blizzard in

October 2013, the sale of Maroc Telecom in May 2014 and mainly

the sale of SFR in November 2014, Vivendi has a Net Cash Position

of €4.6 billion, of which €6.8 billion in cash and cash equivalents and

€2.2 billion in gross financial debt, primarily in bonds for €2.0 billion.

Vivendi has a bank credit facility available for €2.0 billion, undrawn

as of December 31, 2014;

p

p

Vivendi held a portfolio of quoted and unquoted minority interests,

notably Numericable–SFR, Activision Blizzard and TVN in Poland,

as well as at UMG (Spotify, Vevo, Deezer), which represented an

aggregate market value of approximately €5.1 billion (before taxes)

as of December 31, 2014; and

p

p

as part of the current appeals in connection with Liberty Media

Corporation and securities class action litigations in the United

States, Vivendi put into place cash guarantee deposits for an

aggregate amount of approximately €1 billion.

In addition and as a reminder, once the sale of GVT has been completed

(expected during the second quarter of 2015), Vivendi’s portfolio of

securities will increase with the minority interests it will receive in

Telefonica Brasil (VIVO/GVT) and Telecom Italia, which represented an

aggregate market value of approximately €2.8 billion (before taxes) as

of August 28, 2014 (starting date of the exclusive negotiations with

Telefonica).

268

Annual Report 2014