4

Note 11. Receivables Maturity Schedule

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

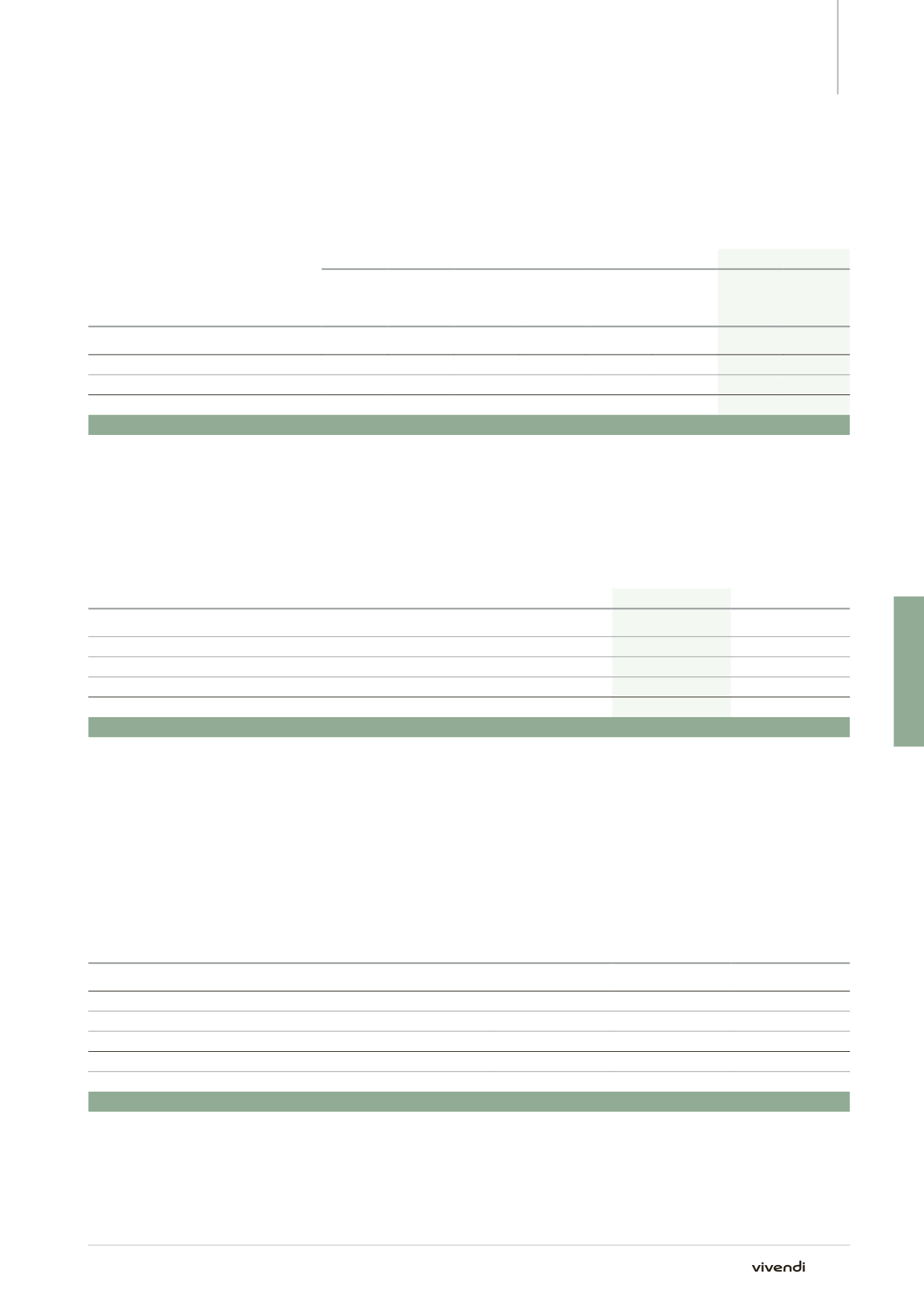

Note 9.

Treasury Shares

Change in Treasury Shares

As of Dec. 31, 2013

Purchases

Sales

As of Dec. 31, 2014

No. Shares

Gross

value

(in millions

of euros)

No.

Shares

Value

(in millions

of euros)

No.

Shares

Value

(in millions

of euros)

No.

Shares

Gross

value

(in millions

of euros)

Long-term investment securities

Liquidity contract

8,135,058

156.6 8,135,058

156.6

Marketable securities

Shares backing performance shares

50,639

0.8 1,602,149

32.1 1,603,220

31.9

49,568

1.0

Total Treasury shares

50,639

0.8 9,737,207

188.7 9,738,278

188.5

49,568

1.0

In 2014, the Company granted 1,603,220 shares to beneficiaries, officers and employees of Vivendi SA and its subsidiaries primarily under the 2010 and

2012 performance share plans.

Note 10.

Other Marketable Securities and Cash

(in millions of euros)

2014

2013

Monetary funds

4,755.0

Medium-term negotiable notes

100.0

Other similar accounts

570.0

100.2

Subtotal-marketable securities

5,425.0

100.2

Cash

1,425.7

210.1

Total

6,850.7

310.3

Marketable securities, excluding treasury shares (see Note 9, Treasury

Shares) amounted to €5,425 million, of which there was €2.1 million in

accrued interest, compared to €100.2 million as of December 31, 2013, of

which there was €0.2 million in accrued interest.

The money market funds benefit from the AMF’s monetary and short-

term monetary classifications. Other similar accounts (deposits and term

deposits) contain an option to terminate at any time.

Note 11.

Receivables Maturity Schedule

(in millions of euros)

Gross value

Maturing in less

than one year

Maturing in more

than one year

Non-current assets

Loans to subsidiaries and affiliates

1,370.4

10.6

1,359.8

Other long-term investments

1,028.5

5.0

1,023.5

Current assets

Trade accounts receivable and related accounts

5.4

4.9

0.5

Other receivables

2,254.1

2,244.2

9.9

Total

4,658.4

2,264.7

2,393.7

313

Annual Report 2014