Corporate Governance Indicators

Involvement in Decisions

3.1.3.

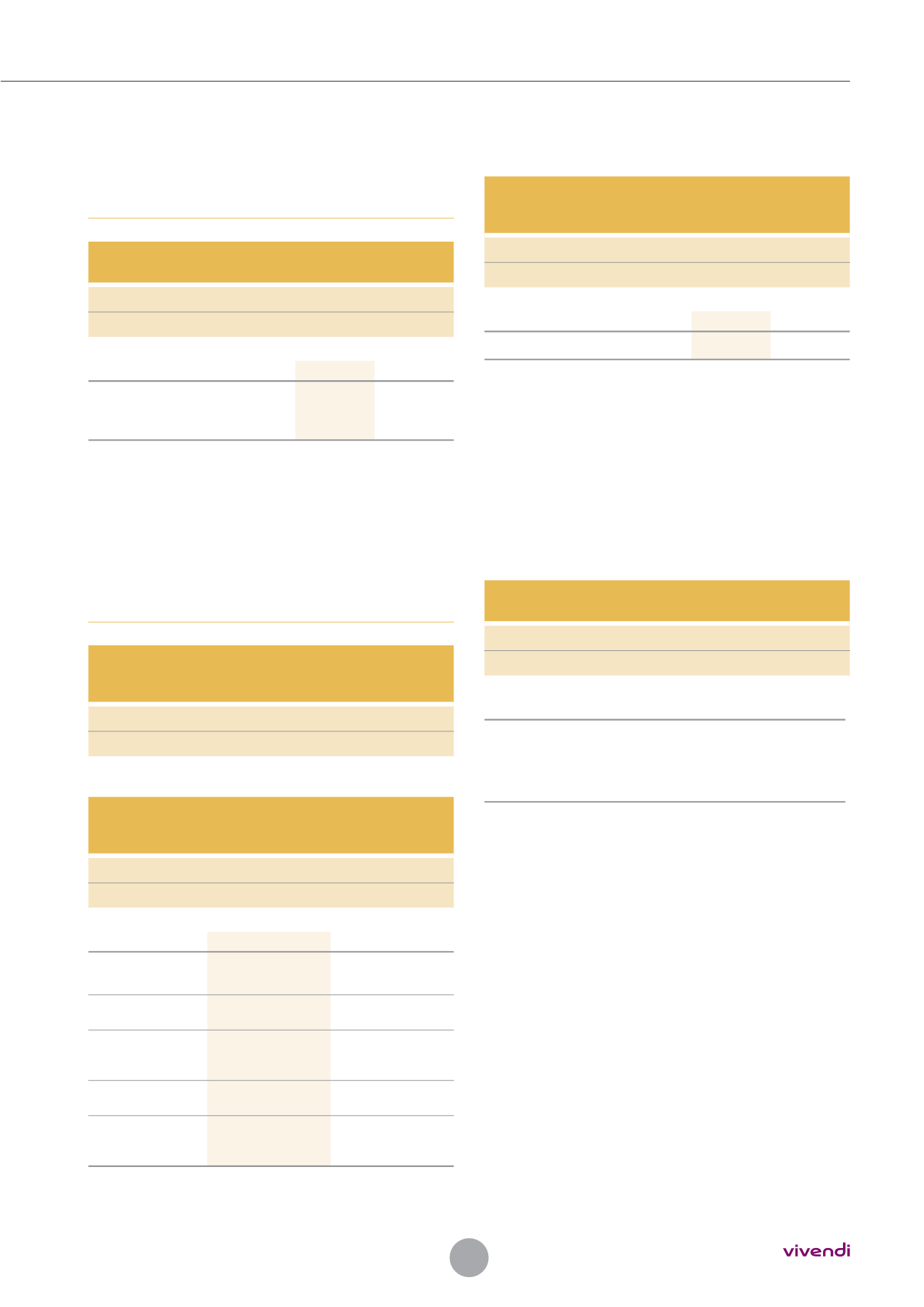

INDEPENDENCE OF AUDITORS IN RELATION

TO MANAGEMENT

PUBLISH A BREAKDOWN OF THE AUDITORS’ AUDIT AND

CONSULTING ASSIGNMENTS

GRI

UNGC

OECD

G4-33, G4-41

-

II.6 and 7, III

2015

2014

Information published

in the Consolidated Financial

Statements of the Annual Report

Note 25

(AR 2015,

p. 277)

Note 28

(AR 2014,

p. 289)

PUBLISH THE NUMBER OF MEETINGS BETWEEN

AUDITORS AND MEMBERS OF THE SUPERVISORY BOARD

WITHOUT PRESENCE OF THE MANAGEMENT BOARD

(1)

GRI

UNGC

OECD

G4-41

-

II.6 and 7, III

2015

2014

Number of meetings

0

0

3.2. Involvement in Decisions

3.2.1.

INVOLVEMENT IN DECISIONS OF THE

MEMBERS OF THE SUPERVISORY BOARD

MAXIMUM OF FIVE TERMS OF OFFICE CUMULATED PER

MEMBER OF THE SUPERVISORY BOARD (EXCLUDING

NON-FRENCH COMPANIES)

GRI

UNGC

OECD

G4-41

-

II.6 and 7, III

In compliance.

PUBLISH THE NUMBER OF MEETINGS AND AVERAGE

ATTENDANCE RATE OF THE SUPERVISORY BOARD

(2)

AND

THE DIFFERENT COMMITTEES THAT MAKE IT UP

(1)

GRI

UNGC

OECD

G4-45, G4-47

-

II.6 and 7, III

2015

2014

Supervisory Board

5

meetings

Attendance rate:

97.2%

10

meetings

Attendance rate:

92.4%

Audit Committee

5

meetings

Attendance rate:

93.32%

6

meetings

Attendance rate:

81.1%

Corporate Governance,

Nominations and

Remuneration Committee

4

meetings

Attendance rate:

91.30%

2

meetings

Attendance rate:

92.8%

Human Resources

Committee

-

3

meetings

Attendance rate:

69.8%

Corporate Governance

and Nomination

Committee

(3)

-

2

meetings

Attendance rate:

100%

EVALUATE THE OPERATION OF THE SUPERVISORY BOARD

EVERY THREE YEARS

(1)

GRI

UNGC

OECD

G4-40, G4-44

-

II.6 and 7, III

2015

2014

Last assessment date

February 2015

(please refer

to Chapter 3,

Section 3.1.1.12

of AR 2015, p. 130)

January 2012

(please refer

to Chapter 3,

Section 3.1.1.12

of AR 2012, p. 130)

In addition, every year, one item on the agenda is dedicated to a

discussion of the performance of the Supervisory Board.

Internal Regulations are in place for the Supervisory Board and for each

of its Committees.

(1)

AFEP/MEDEF Code.

(2)

Other issues put forward by stakeholders.

(3)

In 2014, nominations to the Supervisory Board were examined by the Corporate Governance and Nomination Committee.

EXTRA-FINANCIAL INDICATORS HANDBOOK

2015

21