Simplified organization chart and key figures

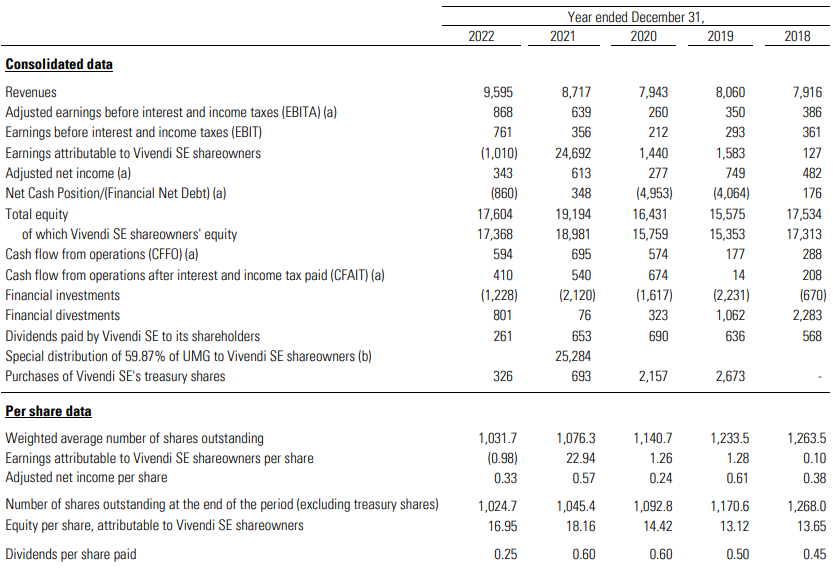

Selected key consolidated financial data

Preliminary comments

As a reminder, Vivendi has applied the following accounting standards for the last five years:

- IFRS 5 – Non-current assets held for sale and discontinued operations: as of December 31, 2022, as a result of Vivendi’s plan to sell Editis (please refer to Note 2.2 to the Consolidated Financial Statements for the year ended December 31, 2022) and in accordance with IFRS 5, Editis has been reported in Vivendi’s Consolidated Statements as a discontinued operation. The adjustments to previously published data are reported in this Financial Report and in Note 29 to the Consolidated Financial Statements for the year ended December 31, 2022. These adjustments were made to all periods as set out in the table of selected key consolidated financial data below.

As a reminder, as from September 14, 2021, the date on which the Management Board approved the loss of control of Universal Music Group (UMG), effective as of September 23, 2021, Vivendi applied IFRS 5 to the Statement of Earnings and Statement of Cash Flows for the year ended December 31, 2021 and the previous years, ensuring that the data below is comparable. - IFRS 16 – Leases: in accordance with IFRS 16, the impact of the change of accounting standard was recorded in the opening balance sheet as of January 1, 2019. In addition, Vivendi applied this change of accounting standard to the Statement of Financial Position, Statement of Earnings and Statement of Cash Flows for the year ended December 31, 2019; therefore, the data relative to fiscal year 2018 is not comparable.

In millions of euros, number of shares in millions, data per share in euros.

(a) The non-GAAP measures of EBITA, Adjusted net income, Net Cash Position (or Financial Net Debt), Cash flow from operations (CFFO) and Cash flow from operations after interest and income tax paid (CFAIT) should be considered in addition to, and not as a substitute for, other GAAP measures of operating and financial performance as presented in the Consolidated Financial Statements and the related Notes or as described in this Financial Report. Vivendi considers these to be relevant indicators of the group’s operating and financial performance.

Each of these indicators is defined in the appropriate section of this Financial Report or in its Appendix. In addition, it should be noted that other companies may have definitions and calculations for these indicators that differ from those used by Vivendi, thereby affecting comparability.

(b) As a reminder, as of September 23, 2021, Vivendi ceded control and deconsolidated 70% of Universal Music Group, following the effective payment of a special distribution in kind of 59.87% of UMG’s share capital to Vivendi’s shareholders, including the distribution of a special interim dividend in kind of €22,100 million in respect of fiscal year 2021.